Macroeconomic environment

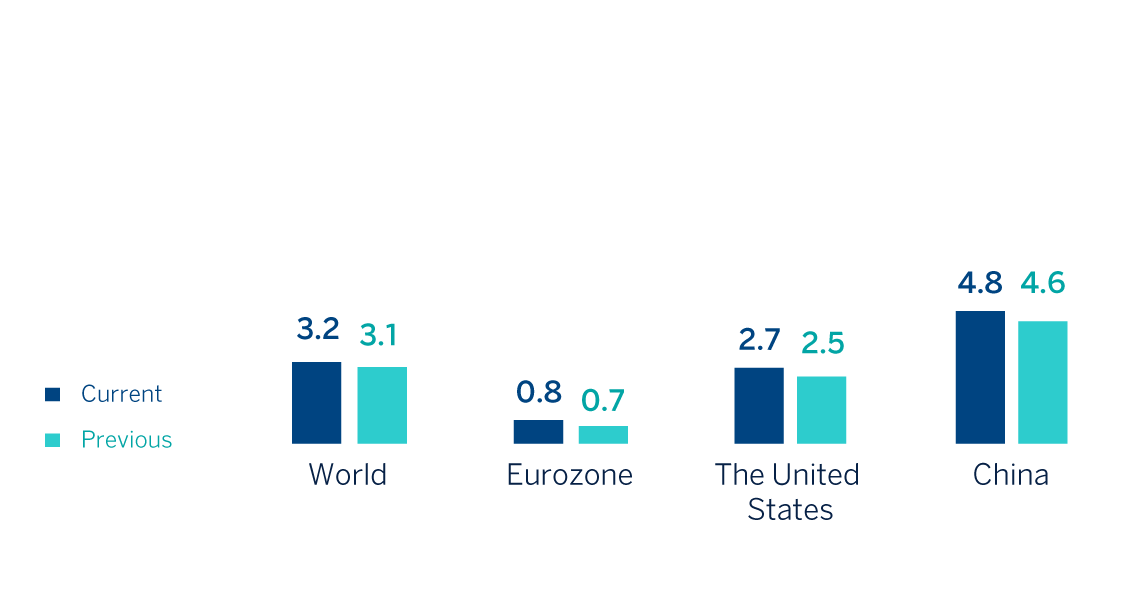

Economic growth remained relatively solid in 2024, mainly in the United States and in the services sector. BBVA Research estimates that global GDP expanded by around 3.2% in 2024, slightly above (3.1%) the forecast three months ago. This strength comes in an environment where the public expenditure was, in general, high and labor markets remained dynamic. In a context marked by general restrictive monetary conditions, despite the process of interest rates cuts, inflation moderated during 2024. This downward trend was supported by a moderation in energy prices (despite geopolitical tensions in some producing regions), and some productivity gains (at least in the United States). Inflation also remains above the target in many geographical areas, mainly in the United States and, pushed down by services prices. The main exception is China, where the process of structural moderation in growth, particularly in domestic demand, has contributed to very low and slightly positive inflation.

Policies adopted by the new administration in the United States, on which there is high uncertainty, will be key in 2025. The expectation of additional protectionist measures and high fiscal deficits would put upward pressure on inflation and downward pressure on growth, according to BBVA Research. Thus, despite recent resilience, US growth would moderate from 2.7% in 2024 (20 basis points above the previous forecast) to 2.0% in 2025 (10 basis points below the previous forecast). The likely upturn in inflation, which closed 2024 at 2.9%, will reduce the scope for the Federal Reserve (hereinafter FED) to ease monetary conditions further. In particular, interest rates, which were cut from 5.5% to 4.5% during 2024, would converge to around 4.0% during the first half of 2025, remaining at these relatively high levels during the second half of the year, which, among other things, would contribute to the strength of the US dollar.

The possible increase in tariffs in the US would be a negative shock to the global economy, whose GDP would moderate to around 3.1% in 2025 (20 basis points lower than previously expected). In particular, it would add to the structural challenges that China and the Eurozone currently face. In this context, BBVA Research forecasts that Eurozone GDP will expand by 1.0% in 2025 (40 basis points lower than previously forecast), having grown by 0.8% in 2024 (10 basis points higher than previously forecast), and that growth in China will moderate to 4.1% in 2025 (10 basis points lower than previously forecast) from 4.8% in 2024 (20 basis points higher than previously forecast). The relative weakness of economic activity would contribute to inflation remaining contained at around 2.0% in the Eurozone and remaining low in China. Against this macroeconomic environment, additional interest rate cuts are likely to be seen in both regions. In particular, in the Eurozone, the European Central Bank (hereinafter ECB), which cut deposit facility rates from 4.0% to 3.0% in the course of 2024, is expected to cut them further to around 2.0% in mid-2025.

Both geopolitical factors, including a further escalation of conflicts in Ukraine or the Middle East, and possible policies of the new US administration, such as those related to foreign trade, migration flows and fiscal policy, create risks for the global macroeconomic environment. In particular, they increase the risk that inflation, and thus interest rates, will remain higher than expected. In addition, they raise the risk of lower than expected GDP growth as well as macroeconomic and financial volatility.

GDP GROWTH ESTIMATES IN 2024

(PERCENTAGE. YEAR-ON-YEAR VARIATION)

Source: BBVA Research estimates.