Additional pro forma information: Corporate & Investment Banking

Highlights

- Significant increase in lending in the year, with sustained quarter-on-quarter growth

- Favorable evolution of recurrent revenues and NTI in the year

- Solid gross income in all geographical areas

- Outstanding attributable profit in 2024

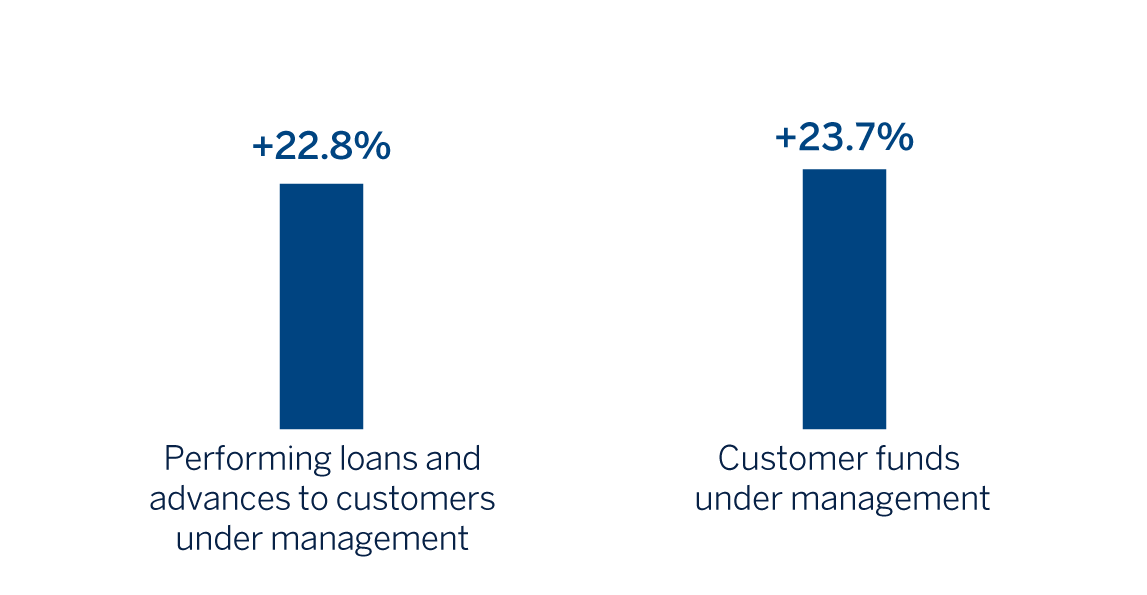

BUSINESS ACTIVITY ⁽(1)

(VARIATION AT CONSTANT EXCHANGE RATES COMPARED TO 31-12-23)

(1) Excluding repos.

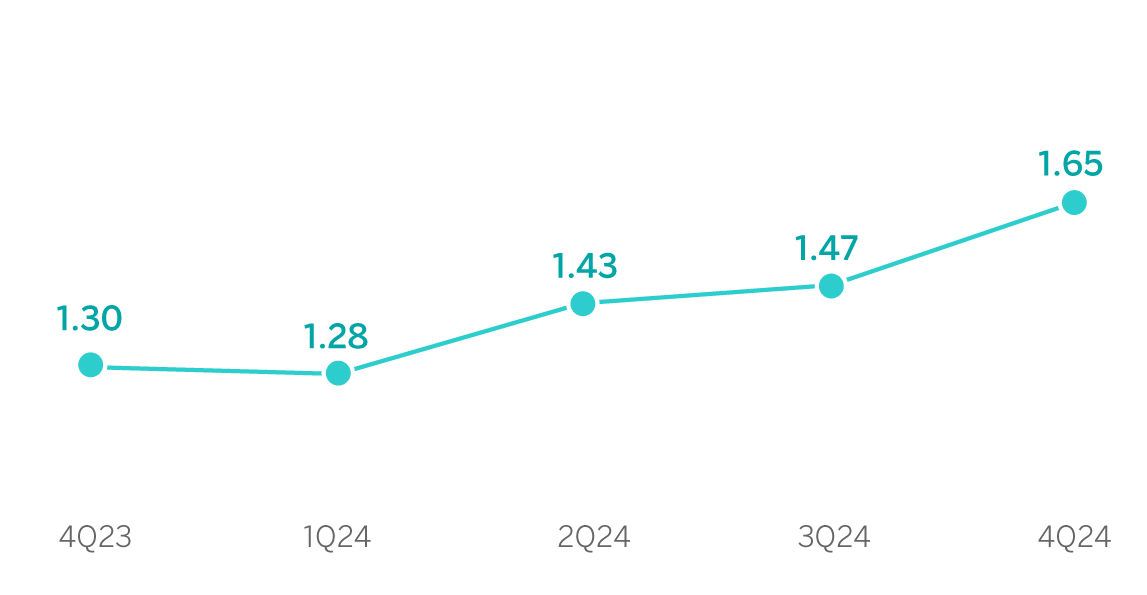

RECURRING REVENUES / AVERAGE TOTAL ASSETS

(PERCENTAGE AT CONSTANT EXCHANGE RATES)

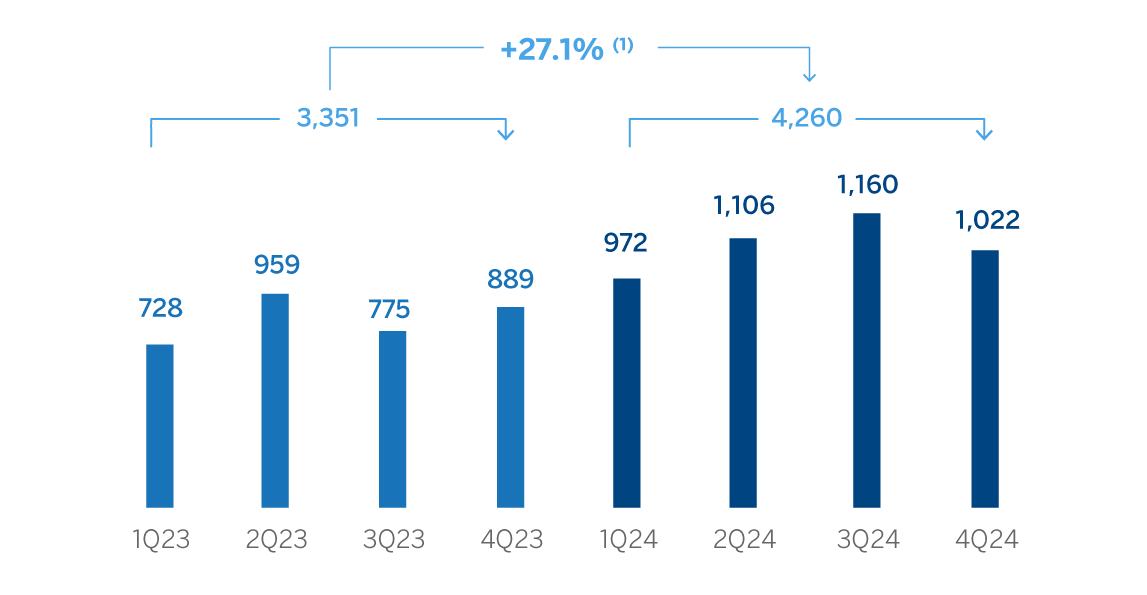

OPERATING INCOME

(MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +21.3%.

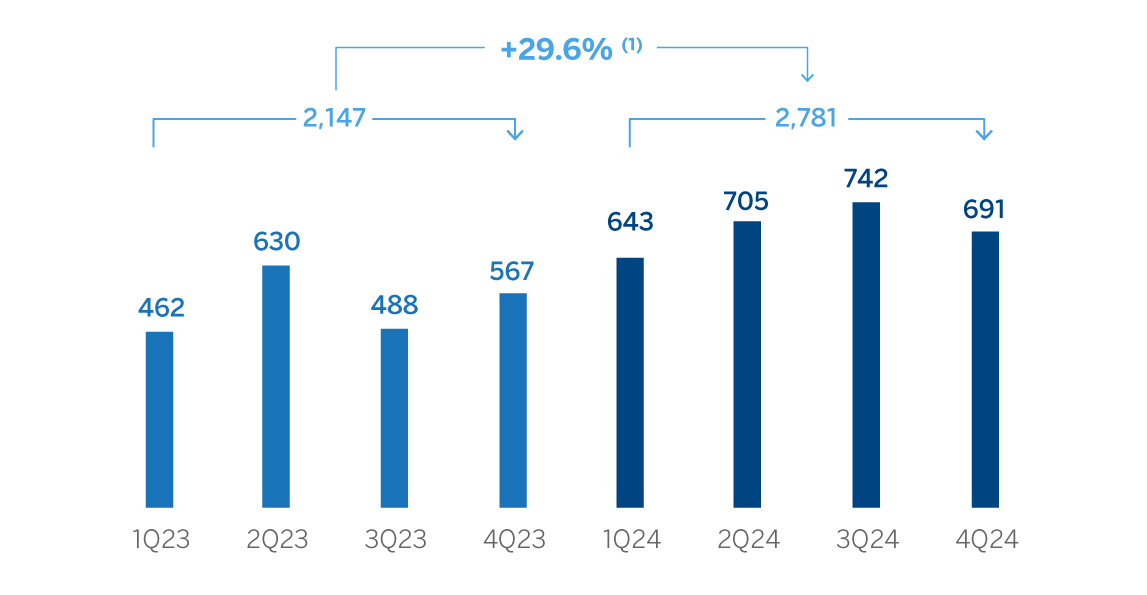

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +24.3%.

The pro forma information of CIB does not include the application of hyperinflation accounting nor the wholesale business of the Group in Venezuela.

| FINANCIAL STATEMENTS AND RELEVANT BUSINESS INDICATORS (MILLIONS OF EUROS AND PERCENTAGE) | ||||

|---|---|---|---|---|

| Income statement | 2024 | ∆ % | ∆ % (2) | 2023 (1) |

| Net interest income | 2,655 | 27.7 | 32.7 | 2,079 |

| Net fees and commissions | 1,198 | 19.1 | 22.0 | 1,006 |

| Net trading income | 2,034 | 15.7 | 20.6 | 1,759 |

| Other operating income and expenses | (56) | (12.6) | (6.1) | (64) |

| Gross income | 5,832 | 22.0 | 26.5 | 4,779 |

| Operating expenses | (1,572) | 24.1 | 24.9 | (1,267) |

| Personnel expenses | (768) | 23.6 | 23.9 | (622) |

| Other administrative expenses | (688) | 27.9 | 29.5 | (538) |

| Depreciation | (115) | 7.5 | 8.0 | (107) |

| Operating income | 4,260 | 21.3 | 27.1 | 3,512 |

| Impairment on financial assets not measured at fair value through profit or loss | 112 | n.s. | n.s. | (7) |

| Provisions or reversal of provisions and other results | (11) | n.s. | n.s. | 2 |

| Profit (loss) before tax | 4,361 | 24.3 | 30.2 | 3,507 |

| Income tax | (1,250) | 24.8 | 31.3 | (1,001) |

| Profit (loss) for the period | 3,111 | 24.2 | 29.8 | 2,506 |

| Non-controlling interests | (330) | 23.1 | 31.9 | (268) |

| Net attributable profit (loss) | 2,781 | 24.3 | 29.6 | 2,238 |

Balance sheets | 31-12-24 | ∆ % | ∆ % (2) | 31-12-23 |

| Cash, cash balances at central banks and other demand deposits | 9,329 | 90.2 | 80.6 | 4,905 |

| Financial assets designated at fair value | 117,625 | (26.2) | (25.5) | 159,372 |

| Of which: Loans and advances | 37,974 | (54.9) | (55.3) | 84,126 |

| Financial assets at amortized cost | 114,618 | 17.8 | 21.1 | 97,302 |

| Of which: Loans and advances to customers | 92,965 | 18.6 | 21.7 | 78,354 |

| Inter-area positions | — | — | — | — |

| Tangible assets | 194 | 38.2 | 36.1 | 141 |

| Other assets | 15,609 | 46.6 | 58.1 | 10,646 |

| Total assets/liabilities and equity | 257,375 | (5.5) | (3.9) | 272,366 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 80,595 | (38.0) | (38.2) | 130,081 |

| Deposits from central banks and credit institutions | 38,054 | 33.5 | 34.9 | 28,502 |

| Deposits from customers | 70,345 | 17.2 | 23.4 | 60,031 |

| Debt certificates | 6,516 | 7.2 | 8.5 | 6,076 |

| Inter-area positions | 42,555 | 45.2 | 51.4 | 29,315 |

| Other liabilities | 6,898 | (5.6) | (6.0) | 7,310 |

| Regulatory capital allocated | 12,412 | 12.3 | 16.3 | 11,050 |

Relevant business indicators | 31-12-24 | ∆ % | ∆ % (2) | 31-12-23 |

| Performing loans and advances to customers under management (3) | 92,913 | 19.9 | 22.8 | 77,510 |

| Non-performing loans | 599 | (33.8) | (27.5) | 905 |

| Customer deposits under management (3) | 65,077 | 19.4 | 25.1 | 54,483 |

| Off-balance sheet funds (4) | 3,844 | (8.2) | 4.9 | 4,189 |

| Efficiency ratio (%) | 27.0 | 26.5 | ||

General note: For the translation of the income statement in those countries where hyperinflation accounting is applied, the punctual exchange rate as of December 31, 2024 is used.

(1) Revised balances. For more information, please refer to the “Business Areas” section.

(2) At constant exchange rates.

(3) Excluding repos.

(4) Includes mutual funds, customer portfolios and other off-balance sheet funds.

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and results, will be given at constant exchange rates. For the conversion of these figures in those countries in which accounting for hyperinflation is applied, the end of period exchange rate as of December 31, 2024 is used. These rates, together with changes at current exchange rates, can be found in the attached tables of financial statements and relevant business indicators. When making comments referring to Europe in this area, Spain is excluded.

Activity

The most relevant aspects related to the area's activity in 2024 were:

- Loan balances increased significantly compared to the end of 2023 (+22.8%), mainly as a result of the favorable development of the Investment Banking & Finance business, with relevant Project Finance and Corporate Lending operations. By geographical areas, the contribution from Europe, the New York branch and Mexico were particularly noteworthy.

- Customer funds grew by 23.7% in 2024, due to the increase in volumes in an environment of competitive prices. The performance by geographical areas was uneven and the evolution of the balances deposited in the branches in Europe and New York was outstanding.

The most relevant aspects related to the area's activity in the fourth quarter of 2024 were:

- The lending activity recorded a new rise (+9.7% higher than at the end of September). During 2024 loans grew steadily quarter after quarter and were close to €90 billion at the end of December. The growth was particularly strong in Europe and, to a lesser extent, in the New York branch.

- The customer funds grew during the last quarter of the year (+11.5%) mainly due to the evolution in Europe, with specific campaigns to attract checking accounts.

Results

CIB generated a net attributable profit of €2,781m in 2024. These results represent an increase of 29.6% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients16.

All the business divisions achieved good results, particularly Investment Banking & Finance (IB&F) with an excellent evolution of net interest income in all geographical areas, supported by higher lending volumes and better prices, the contribution of Global Markets supported by the reactivation of commercial activity and Global Transaction Banking (GTB) which consolidated its positive trend, particularly in Mexico, Turkey and the United States.

The most relevant aspects of the year-on-year income statement evolution of this aggregate as of end of December 2024 are summarized below:

- Net interest income for the quarter was 32.7% higher than in the same period of the previous year, partly due to the good performance of the business activity, which benefited from higher volumes and, especially Europe and the United States as well as certain geographical areas, thanks to an adequate price management.

- Net fees and commissions increased 22.0%, with favorable evolution in all businesses. The primary market debt issuance activity, the liquidity management in South America and relevant operations in Project Finance and Corporate Lending are noteworthy.

- Excellent NTI evolution (+20.6%), mainly due to the performance of the Global Markets unit. Fixed-income trading was particularly strong during the year, while currency trading slowed down compared to the previous year. For its part, commercial activity showed significant growth in all geographical areas except Turkey, with special mention to the evolution of Spain, Europe, Mexico and the United States.

- Operating expenses increased by 24.9% due to new personnel hires carried out during 2023 and 2024. On the other hand, general expenses continue to be affected by inflation and by higher technology expenditures linked to the execution of strategic projects for the area. However, the efficiency ratio stood at 27.0% at the end of December 2024, which represents an improvement of 35 basis points compared to the figure registered at the end of 2023, thanks to the strong growth in gross margin.

- Provisions for impairment on financial assets line recorded a release of €112m, mainly originated from certain specific customers in Turkey, which compares with €7m provided in the previous year.

In the fourth quarter of 2024 and excluding the effect of the variation in exchange rates, the Group's wholesale businesses generated a net attributable profit of €691m (-7.0% compared to the previous quarter). This performance was mainly due to lower NTI in the Global Markets unit, partly offset by a favorable evolution of net interest income and fees. Operating expenses increased, mainly due to higher personnel and technology costs, associated with the area's strategic plans. Lastly, loan-loss provisions declined, due to the release of provisions in Turkey.

16 CIB results do not include the application of hyperinflation accounting.