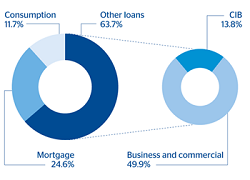

As of 31-Mar-2013 the United States managed a volume of performing loans of €38,648m, of which 93% were in BBVA Compass. The area shows very stable performance in its total loan portfolio compared to the first and fourth quarters of 2012. However, year-on-year, BBVA Compass is up 8.6%.

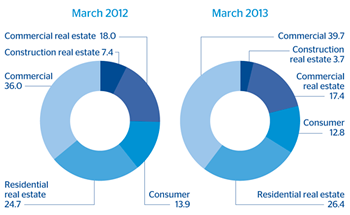

Selective growth in lending continues to characterize the commercial effort made in the area and by BBVA Compass. The construction real estate portfolio continues to decline (down 47.1% year-on-year). Lending to corporates (commercial real estate and other companies, including the CIB portfolios) remains very stable, despite its good performance at BBVA Compass, due to the ongoing deleveraging process in the wholesale segment portfolios in the New York office. Consumer loans and credit cards have been flat. However, there have been significant increases in mortgages for retail customers (residential real estate), which are up 16.8% year-on-year.

Asset quality and risk management in the area have improved significantly over the quarter. The total volume of non-performing assets has fallen by 25.3% compared with the figure for the end of 2012 (at current exchange rates), resulting in a decrease of 53 basis points in the NPA ratio to 1.8% in the quarter. The coverage ratio has also increased by over 18 percentage points since December 2012 and closed March at 109%.

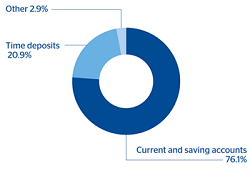

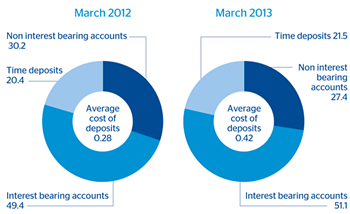

On-balance-sheet customer deposits have grown year-on-year by 8.0% (up 2.9% over the quarter) to €40,002m. Of this amount, 76% corresponds to current and saving accounts and 21% to time deposits. Time deposits have performed best, growing by 14.5% over 12 months and 3.1% over the quarter.

The United States. Performing loans breakdown(March 2013) |

The United States. Deposits from customers breakdown(March 2013) |

|---|---|

|

|

BBVA Compass. Loan mix(Percentage) |

BBVA Compass. Deposit mix(Percentage) |

|---|---|

|

|