The following are the most important figures related to earnings in the first quarter of 2013 in this business area:

- Strong net interest income, which has risen by 31.1% in the last 12 months as a result of the positive management of customer spreads. Specifically, in the first quarter of the year, the cost of lira liabilities in Garanti has continued to fall, maintaining the trend started in the third quarter of 2012.

- A 3.7% decline in income from fees and commissions, basically due to falling activity in the wholesale market in the area, although the figure for Garanti is positive, above all in terms of fees from consumer finance, project finance and brokerage services.

- Favorable performance of NTI as a result of a positive trend in trading activities.

- A lower contribution from CNCB, due to the increase in loan-loss provisions by the Chinese bank in response to the coming into effect of new provisioning policies at local level.

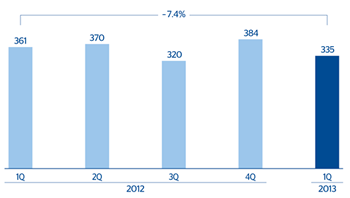

- As a result, gross income stands at €511m, down 4.5% on the figure for the same period in 2012.

- Expenses have been kept under control and barely grew by 1.5% over the last 12 months.

- There was a year-on-year increase in impairment losses on financial assets and provisions (net) and other gains (losses), in line with expectations. This reduced €108m the income statement. Nevertheless, this figure is far below that in the fourth quarter of 2012, when there were exceptionally high one-off provisions in Portugal.

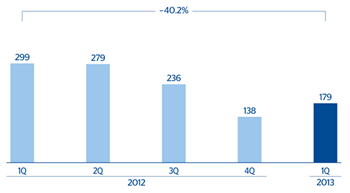

- To sum up, Eurasia generated net attributable profit of €179m in the first quarter of 2013. The fall on the figure for the same period in 2012 can be explained by the lower contribution from CNCB.

Europe’s contribution to Eurasia earnings is 70.4%, i.e. €126m. Of this figure, €106m is from Turkey. The Garanti Group generated net attributable profit of €501m in the first quarter of 2013. This figure was the result of increased business activity, a diversified revenue base and disciplined cost management. Once more, these sound fundamentals are reflected in the capital ratio of Garanti Bank, which stood at 18.2% under Basel II criteria in February 2013, above the average in the sector.

Garanti. Significant data 31-03-13 (1)

|

|

31-03-13 |

|---|---|

| Financial statements (million euros) |

|

| Attributable profit | 426 |

| Total assets | 71,979 |

| Loans to customers | 41,558 |

| Deposits from customers | 39,160 |

| Relevant ratios (%) |

|

| Efficiency ratio | 36.6 |

| NPA ratio | 2.3 |

| Other information |

|

| Number of employees | 17,989 |

| Number of branches | 947 |

| Number of ATMs | 3,559 |

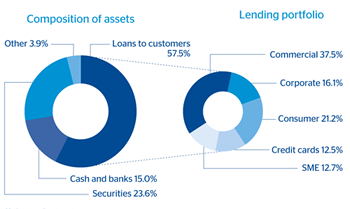

Garanti. Composition of assets and lending portfolio (1)(March 2013) |

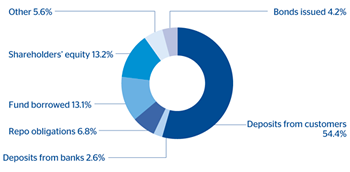

Garanti. Composition of liabilities (1)(March 2013) |

|---|---|

(1) Garanti Bank only. |

(1) Garanti Bank only. |

Finally, Asia has posted cumulative net attributable profit of €53m, accounting for 29.6% of earnings in the area. The lower contribution is a result of the fall in earnings at CNCB, due to the increase in loan-loss provisions as a result of the coming into effect of new provisioning policies at local level. According to the latest figures published as of 31-Dec-2012, CNCB earnings were very similar to those of the previous year (up 0.7%). With respect to business activity, deposit gathering was very successful (up 15.4% year-on-year), with a bigger increase than lending (up 14.6% year-on-year). Finally, CNCB improved its coverage ratio, while its capital ratio under local criteria stood at 13.4% at the close of the fourth quarter of 2012.

Eurasia. Operating income(Million euros) |

Eurasia. Net attributable profit(Million euros) |

|---|---|

|

|

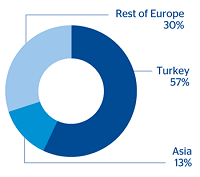

Eurasia. Gross income breakdown by geography(31-03-2013) |

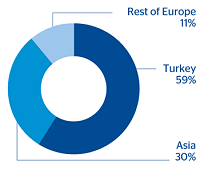

Eurasia. Net attributable profit b by geography(31-03-2013) |

|---|---|

|

|