At the close of the first quarter of 2013, South America once more performed well in practically all the countries where BBVA operates, both on the side of lending and on-balance sheet customer funds.

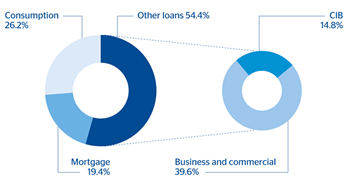

The balance of performing loans as of March 31, 2013 was €46,128m, a year-on-year growth of 15.0%. Once more, lending to the retail segment performed outstandingly well, particularly consumer finance (up 22.0%), credit cards (up 36.5%) and to a lesser extent mortgage lending (up 16.2%). This is reflected in a 17 basis points year-on-year gain in market share of individual customers, according to the latest available information as of January 2013.

The rise in lending activity has been coupled with strict risk admission policies and a good management of recoveries. These lines of action, which are closely in line with those for the corporate segment, have maintained the main risk indicators stable over the quarter. In fact, the NPA ratio closed as of 31-Mar-2013 at 2.2%, while the coverage ratio stood at 143%.

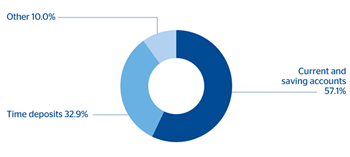

On-balance sheet customer deposits (excluding repos) have continued to increase their year-on-year pace of growth to 23.7%, closing March at €55,595m. Lower-cost transactional items (current and savings accounts) drove growth, with a rise of 29.3% over the same period and a market share gain of 12 basis points from January 2012 to January 2013. Including assets under management by mutual funds, customer funds managed by the banks in South America amounted to €59,403m, 23.9% up on the same date the previous year, with a rise in market share over the year of 13 basis points, again using data for January 2013 (all figures mentioned below on market share refer to January 2013, the latest information available).

The most notable points to highlight in the main countries where the Group operates are the following:

- In Argentina, the loan book has grown 23.6% year-on-year and on-balance sheet customer funds at 17.7%.

- Chile: continues to post increases in lending above the average of the system (up 9.3% in year-on-year terms). This has enabled it to increase its market share over the past 12 months (up 2 basis points), above all in consumer finance (up 17 basis points) and mortgage lending (up 37 basis points). On-balance sheet customer funds grew by 6.2%, with an increase in demand and savings deposits of 14.7% and a rise in the market share of 15 basis points over the last 12 months.

- In Colombia lending was up 14.8% year-on-year, mainly due to strong growth in the consumer portfolio and credit cards held by individual customers (up 27.0%). The year-on-year rise in market share is 119 basis points for consumer finance and 30 basis points for credit cards. Customer funds increased at higher rates than the system as a whole (up 37.0% year-on-year) and gained 144 basis points of market share.

- Peru has also showed a significant rise in activity, both in lending and, above all, in on-balance sheet customer funds (up 9.2% and 17.2%, respectively in year-on-year terms). Outstanding was the growth in credit cards (up 27.0%), mortgage lending (up 21.4%) and current and savings accounts (up 13.1%).

- In Venezuela, year-on-year growth in performing loans was 41.8% and in customer funds 54.0%.

South America. Performing loans breakdown(March 2013) |

South America. Deposits from customers breakdown(March 2013) |

|---|---|

|

|