Relevant events

Results

- Generalized sustained growth in more recurrent sources of revenue in practically all geographic areas.

- Operating expenses remain under control, leading to an improvement in the efficiency ratio in comparison with 2016.

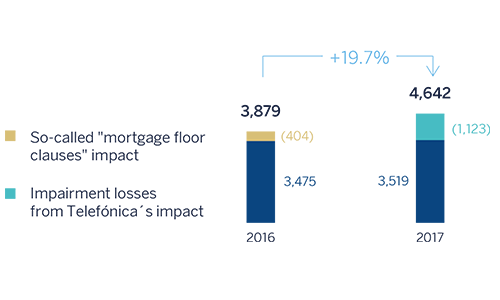

- Impairment losses on financial assets has been influenced by the recognition of impairment losses of €1,123m from BBVA's stake in Telefónica, S.A.

- As a result, the net attributable profit was €3,519m. Without taking into account the impacts of the impairment losses in Telefónica in 2017 and the so-called "mortgage floor clauses" in 2016, the net attributable profit was up year-on-year by 19.7%.

Net attributable profit (Million euros)

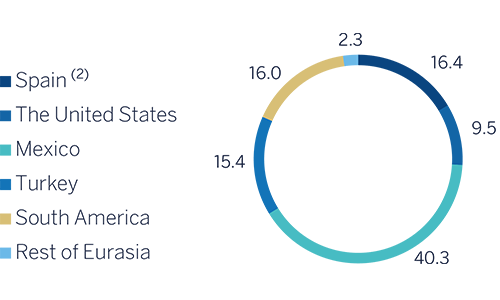

Net attributable profit breakdown (1) (Percentage. 2017)

(1) Excludes the Corporate Center.

(2) Includes the areas Banking activity in Spain and Non Core Real Estate.

Balance sheet and business activity

-

The year-on-year comparison of the Group's balance sheet and business activity has been affected by the operations underway (sales of BBVA Chile and the real-estate business in Spain), which as of 31-Dec-2017 were reclassified as non-current assets and liabilities held for sale. Without taking into account the said reclassification (figures in comparable terms with respect to previous periods):

- Loans and advances to customers (gross) continue to increase in emerging geographies but decline in Spain. There has been a slight recovery in the United States since the second half of 2017.

- Non-performing loans continue to improve favorably.

- Deposits from customers have performed particularly well in the more liquid and lower-cost items.

- There was an increase in off-balance-sheet funds, mainly in mutual funds.

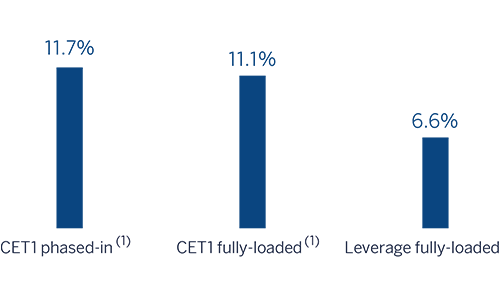

Solvency

- The capital position is above regulatory requirements and in line with the target established for the fully-loaded CET1 of 11%. The recognition of the impairment losses from Telefónica mentioned above does not negatively affect the Group's solvency, as they are deducted from both equity and CET1.

Capital and leverage ratios (Percentage as of 31-12-17)

(1) Includes update of the calculation on Structural FX RWA, pending confirmation by ECB.

Risk management

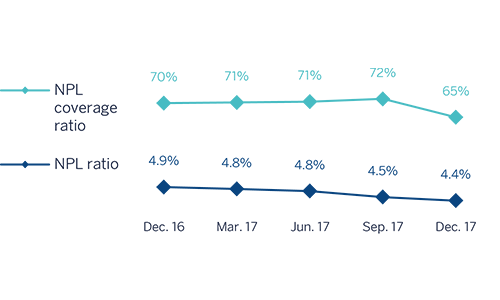

- Good performance of the main credit risk metrics: as of 31-Dec-2017, the NPL ratio closed at 4.4%, the NPL coverage ratio at 65% and the cumulative cost of risk at 0.87%.

NPL and NPL coverage ratios (Percentage)

Transformation

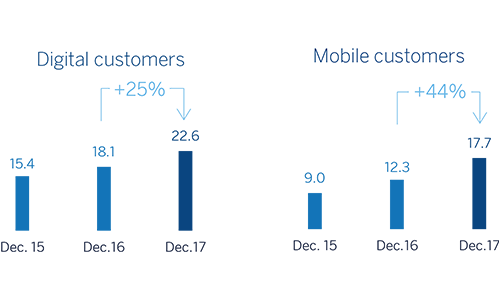

- The Group's digital and mobile customer base and digital sales continue to increase in all the geographic areas where BBVA operates.

Digital and mobile customers (Millions)

Other matters of interest

- It is expected to be proposed for the consideration of the competent governing bodies a cash payment in a gross amount of euro 0.15 per share to be paid in April as final dividend for 2017.