Balance sheet and business activity

The year-on-year comparison of the Group's balance sheet and business activity have been affected by the operations currently underway (the sales of BBVA Chile and the real-estate business in Spain), which as of December 31, 2017 were reclassified as non-current assets and liabilities held for sale (in the accompanying balance sheet, under the headings of other assets and other liabilities, respectively). Without taking into account the said reclassification (figures in comparable terms with respect to previous periods), the most significant items are shown below:

- Geographic disparity of loans and advances to customers (gross). Lending increased in the emerging economies, while Spain continued to deleverage. The United States registered a slight increase in lending during the second half of the year, resulting in the year-on-year loan balance closing at very similar levels.

- Non-performing loans declined again, thanks to an improvement in Spain and the United States.

- In deposits from customers, there was another notable increase across the board in lower-cost items such as current and savings accounts, and a decline in time deposits.

- Off-balance-sheet funds continued to perform well in all items (mutual funds, pension funds and other customer funds).

Consolidated balance sheet (Million euros)

| 31-12-17 | ∆% | 31-12-16 | 30-09-17 | |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 42,680 | 6.6 | 40,039 | 36,023 |

| Financial assets held for trading | 64,695 | (13.7) | 74,950 | 65,670 |

| Other financial assets designated at fair value through profit or loss | 2,709 | 31.4 | 2,062 | 2,848 |

| Available-for-sale financial assets | 69,476 | (12.3) | 79,221 | 74,599 |

| Loans and receivables | 431,521 | (7.4) | 465,977 | 449,564 |

| Loans and advances to central banks and credit institutions | 33,561 | (16.7) | 40,268 | 36,556 |

| Loans and advances to customers | 387,621 | (6.5) | 414,500 | 401,734 |

| Debt securities | 10,339 | (7.8) | 11,209 | 11,275 |

| Held-to-maturity investments | 13,754 | (22.3) | 17,696 | 14,010 |

| Investments in subsidiaries, joint ventures and associates | 1,588 | 107.5 | 765 | 1,584 |

| Tangible assets | 7,191 | (19.6) | 8,941 | 7,963 |

| Intangible assets | 8,464 | (13.5) | 9,786 | 8,743 |

| Other assets | 47,981 | 48.0 | 32,418 | 29,793 |

| Total assets | 690,059 | (5.7) | 731,856 | 690,797 |

| Financial liabilities held for trading | 46,182 | (15.5) | 54,675 | 45,352 |

| Other financial liabilities designated at fair value through profit or loss | 2,222 | (5.0) | 2,338 | 2,372 |

| Financial liabilities at amortized cost | 543,713 | (7.7) | 589,210 | 559,289 |

| Deposits from central banks and credit institutions | 91,570 | (6.8) | 98,241 | 84,927 |

| Deposits from customers | 376,379 | (6.2) | 401,465 | 392,865 |

| Debt certificates | 63,915 | (16.3) | 76,375 | 69,285 |

| Other financial liabilities | 11,850 | (9.7) | 13,129 | 12,212 |

| Liabilities under insurance contracts | 9,223 | 0.9 | 9,139 | 9,665 |

| Other liabilities | 35,395 | 68.0 | 21,066 | 19,720 |

| Total liabilities | 636,736 | (5.9) | 676,428 | 636,397 |

| Non-controlling interests | 6,979 | (13.5) | 8,064 | 7,069 |

| Accumulated other comprehensive income | (8,792) | 61.1 | (5,458) | (7,956) |

| Shareholders’ funds | 55,136 | 4.4 | 52,821 | 55,287 |

| Total equity | 53,323 | (3.8) | 55,428 | 54,400 |

| Total equity and liabilities | 690.059 | (5.7) | 731,856 | 690,797 |

| Memorandum item: | ||||

| Collateral given | 47,671 | (5.7) | 50,540 | 45,489 |

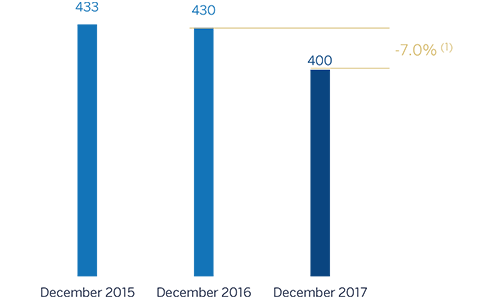

Loans and advances to customers (gross)

(Billion euros)

(1) At constant exchange rates: +2.7%.

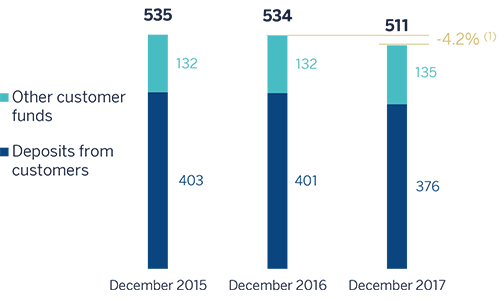

Customer funds

(Billion euros)

(1) At constant exchange rates: +1.9%.

Loans and advances to customers

(Million euros)

| 31-12-17 | ∆% | 31-12-16 | 30-09-17 | |

|---|---|---|---|---|

| Public administration | 25,671 | (6.7) | 27,506 | 25,828 |

| Individuals | 159,781 | (7.4) | 172,476 | 169,245 |

| Residential mortgages | 109,563 | (10.5) | 122,439 | 117,273 |

| Consumer | 36,235 | 3.0 | 35,195 | 37,556 |

| Credit cards | 13,982 | (5.8) | 14,842 | 14,416 |

| Business | 175,168 | (7.7) | 189,733 | 184,199 |

| Business retail | 19,692 | (19.1) | 24,343 | 20,185 |

| Other business | 155,476 | (6.0) | 165,391 | 164,014 |

| Other loans | 20,358 | 14.1 | 17,844 | 16,745 |

| Non-performing loans | 19,390 | (15.4) | 22,915 | 20,222 |

| Loans and advances to customers (gross) |

400,369 | (7.0) | 430,474 | 416,240 |

| Loan-loss provisions | (12,748) | (20.2) | (15,974) | (14,506) |

| Loans and advances to customers |

387,621 | (6.5) | 414,500 | 401,734 |

Customer funds

(Million euros)

| 31-12-17 | Δ% | 31-12-16 | 30-09-17 | |

|---|---|---|---|---|

| Deposits from customers | 376,379 | (6.2) | 401,465 | 392,865 |

| Current accounts | 245,249 | 5.9 | 231,638 | 242,566 |

| Time deposits | 110,320 | (23.6) | 144,407 | 127,897 |

| Assets sold under repurchase agreement | 8,119 | (26.6) | 11,056 | 10,442 |

| Other deposits | 12,692 | (11,6) | 14,364 | 11,959 |

| Other customer funds | 134,906 | 2.1 | 132,092 | 137,724 |

| Mutual funds and investment companies | 60,939 | 10.7 | 55,037 | 60,868 |

| Pension funds | 33,985 | 1.7 | 33,418 | 33,615 |

| Other off-balance sheet funds | 3,081 | 8.8 | 2,831 | 3,293 |

| Customer portfolios | 36,901 | (9.6) | 40,805 | 39,948 |

| Total customer funds | 511,285 | (4.2) | 533,557 | 530,589 |