Solvency

Capital base

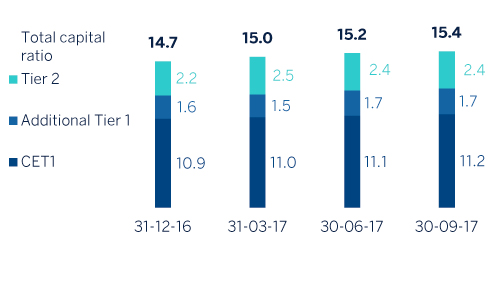

BBVA Group had a fully-loaded CET1 ratio stood at 11.2% at the end of September 2017, above the target of 11%. This ratio has increased around 30 basis points so far this year, leveraged on organic earning generation and RWA reduction.

In 2017 the capital ratio has been affected by the acquisition of an additional 9.95% stake in Garanti and the sale of CNCB. These transactions have had a combined negative impact on the ratio of 13 basis points.

As of 30 September, RWAs continued to decline relative to December 2016. This is largely the result of the depreciation of currencies against the euro (in particular, the Turkish lira and U.S. dollar), the improvement in the risk profile of the Group's portfolio (primarily in Spain), and a €3,000m synthetic securitization in the second quarter, which freed up €683m in RWAs.

In terms of capital issuances, in the second quarter BBVA S.A. issued €500m in additional tier 1 capital (contingent convertible), which contributed 13 basis points to the total capital ratio. In addition, BBVA Group has undertaken various subordinate capital issues over the year, worth a nominal amount of close to €1,500m. Meanwhile, Garanti in Turkey issued $750m in the second quarter. These transactions compute as Tier 2 capital and had an aggregate impact of some 50 basis points on the Group's total capital ratio.

Finally, the last "dividend-option" program was completed in April, with holders of 83.28% of rights choosing to receive new shares. On October 10, an interim dividend for 2017 in the amount of €0.09 per share was distributed in line with the shareholder remuneration policy announced in February.

The phased-in CET1 ratio was 11.9% as of 30-Sep-2017, the Tier 1 ratio reaching 13.1% and the Tier 2 ratio 2.5%, resulting in a total capital ratio a total capital ratio of 15.7%. These levels are above the requirements established by the European Central Bank (ECB) in its SREP letter and the systemic buffers applicable to BBVA Group for 2017 (7.625% for the phased-in CET1 ratio and 11.125% for the total capital ratio).

Finally, the Group maintains a sound leverage ratio: 6.7% under fully-loaded criteria (6.9% phased-in), which continues to be the highest in its peer group.

Evolution of fully-loaded capital ratios (Percentage)

Capital base (1) Million euros

| CRD IV phased-in (1) | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 30-09-2017 (2) | 31-12-16 | 30-09-16 | 30-09-2017 (2) | 31-12-16 | 30-09-16 | |

| Common Equity Tier 1 (CET 1) | 43,412 | 47,370 | 47,801 | 40,919 | 42,398 | 42,762 |

| Tier 1 | 48,002 | 50,083 | 50,545 | 47,157 | 48,459 | 48,771 |

| Tier 2 | 9,237 | 8,810 | 11,635 | 8,953 | 8,739 | 11,716 |

| Total Capital (Tier 1 + Tier 2) | 57,239 | 58,893 | 62,180 | 56,110 | 57,198 | 60,487 |

| Risk-weighted assets | 365,507 | 388,951 | 389,814 | 365,507 | 388,951 | 388,862 |

| CET1 (%) | 11.9 | 12.2 | 12.3 | 11.2 | 10.9 | 11.0 |

| Tier 1 (%) | 13.1 | 12.9 | 13.0 | 12.9 | 12.5 | 12.5 |

| Tier 2 (%) | 2.5 | 2.3 | 3.0 | 2.4 | 2.2 | 3.0 |

| Total capital ratio (%) | 15.7 | 15.1 | 16.0 | 15.4 | 14.7 | 15.6 |

- (1) The capital ratios are calculated under CRD IV from Basel III regulation, applying a 80% phase-in for 2017 and a 60% for 2016.

- (2) Preliminary data.

Ratings

Since July 2017, none of the credit rating agencies have modified BBVA's rating. It therefore remains at the levels shown in the accompanying table.

Ratings

| Rating agency | Long term | Short term | Outlook |

|---|---|---|---|

| DBRS | A | R-1 (low) | Stable |

| Fitch | A- | F-2 | Stable |

| Moody’s (1) | Baa1 | P-2 | Stable |

| Scope Ratings | A+ | S-1 | Stable |

| Standard & Poor’s | BBB+ | A-2 | Positive |

- (1) Additionally, Moody’s assigns an A3 rating to BBVA’s long term deposits.