Own funds and Capital

The following are considered for the purpose of calculating the minimum capital requirements under the solvency regulations: the elements and instruments corresponding to Tier 1 capital, which is defined as the sum of Common Equity Tier 1 capital (CET1) and additional Tier 1 capital (AT1), as defined in Part Two, Title I, Chapters I to III of the CRR, as well as their corresponding deductions, in accordance with articles 36 and 56, respectively.

Also considered are the elements of Tier 2 capital defined in Part Two of Chapter IV, section I of the CRR. The deductions defined as such in section II of the same Chapter are also considered.

The table below shows the amount of total eligible capital, net of deductions, for the different items making up the capital base as of December 31, 2017 and December 31, 2016, in accordance with the disclosure requirements for information relating to temporary capital set out by Implementing Regulation (EU) No. 1423/2013 of the Commission dated December 20, 2013:

Amount of capital

| Eligible capital resources | 31/12/2017 | 31/12/2016 |

|---|---|---|

| a) Capital and share premium | 27,259 | 27,210 |

| b) Retained earnings | 25,504 | 23,688 |

| c) Other accumulated earnings (and reserves) | (8,710) | (5,500) |

| d) Minority interests | 5,446 | 6,969 |

| e) Net attrib. profit and interim and final Group dividends | 1,436 | 1,973 |

| Ordinary Tier 1 Capital before other reglamentary adjustments | 50,935 | 54,339 |

| f) Additional value adjustments | (332) | (250) |

| g) Intangible assets | (6.627) | (5.675) |

| h) Deferred tax assets | (755) | (453) |

| i) Fair value reserves related to gains o losses on cash flow hedges | (193) | - |

| j) Expected losses in equity | (20) | (16) |

| k) Profit or losses on liabilities measured at fair value | - | - |

| l) Direct and indirect holdings of own instruments | (278) | (181) |

| m) Securitisations tranches at 1250% | (39) | (62) |

| n) Temporary CET1 adjustments | (324) | (332) |

| o) Admisible CET1 deductions | (26) | - |

| Total de los ajustes reglamentarios de capital de nivel 1 ordinario | (8,594) | (6,969) |

| Common Equity Tier 1 (CET1) | 42,341 | 47,370 |

| p) Equity instruments and share premium classified as liabilities | 5,751 | 5,423 |

| q) Items referred in Article 484 (4) of the CRR | 142 | 691 |

| r) Qualifying Tier 1 capital included in consolidated AT1 capital (including minority interests not included in row d) issued by subsidiaries and held by third parties | 403 | 383 |

| Additional Tier 1 before reglamentary adjustments | 6,296 | 6,497 |

| s) Ajustes transitorios Tier 1 | (1,657) | (3,783) |

| Total reglamentary adjustments of Additional Tier 1 | (1,657) | (3,783) |

| Additional Tier 1 (AT1) | 4,639 | 2,713 |

| Tier 1 (Common Equity Tier 1+Additional Tier 1) | 46,980 | 50,083 |

| t) IEquity instruments and share premium | 1,59 | 2,57 |

| u) Amount of the admissible items, pursuant to Article 484 | - | - |

| v) Admissible shareholders' funds instruments included in consolidated Tier 2 issued by subsidiaries and held by third parties | 6,438 | 5,915 |

| Of which: instruments issued by subsidiaries subject to ex-subsidiary stage | 317 | 350 |

| w) Credit risk adjustments | 601 | 538 |

| Tier 2 before reglamentary adjustments | 8,798 | 8,810 |

| Tier 2 reglamentary adjustments | - | - |

| Tier 2 | 8,798 | 8,810 |

| Total Capital (Total capital = Tier 1 + Tier 2) | 55,778 | 58,893 |

| Total APR's | 362,875 | 388,951 |

| CET 1 (Phase-in) | 11.67% | 12.18% |

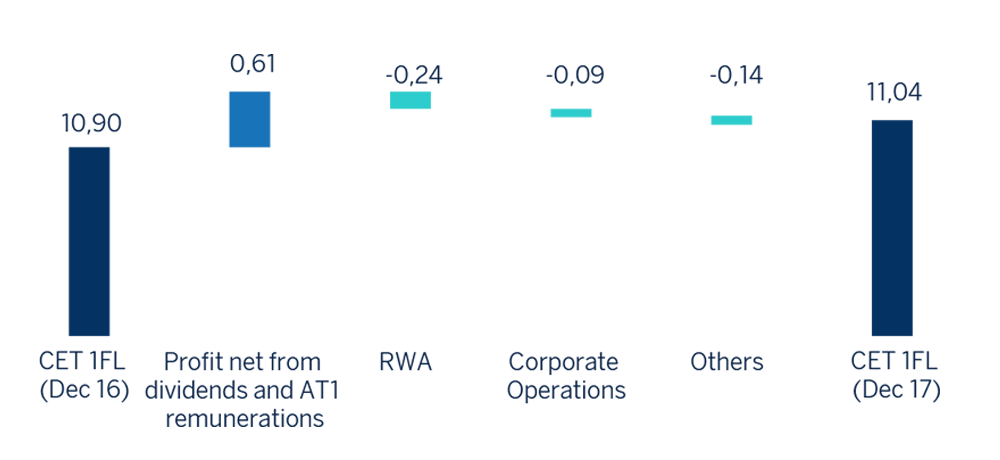

| CET 1 (fully loaded) | 11.04% | 10.90% |

| Tier 1 (Phase in) | 12.95% | 12.88% |

| Tier 1 (fully loaded) | 12.76% | 12.46% |

| Total Capital (Phase in) | 15.37% | 15.14% |

| Total Capital (fully loaded) | 15.14% | 14.71% |

As of December 31, 2017, the phased-in Common Equity Tier 1 (CET1) stood at 11.67%, accounting a decrease with respect to December 2016 of 51 basis points. The negative effect on the minority interests and deductions due to the regulatory phase-in calendar of 80% in 2017 compared to 60% in 2016 has an impact of -57 basis points which is compensated by the organic generation of capital leaning against the recurrence of the results, net of dividends paid and remunerations.

It is also worth noting that in 2017 there were corporate operations that had an impact on CET1, particularly the acquisition of an additional 9.95% stake in Garanti Bank, the sale of 1.7% of the stake in CNCB and the capital increase of Banco Francés (the Group's subsidiary in Argentina), with an impact of approximately -9 basis points on CET1.

Additionally, BBVA Group has registered on December 2017 losses of €1,123 billion due to the unrealised losses from its stake in Telefónica. However, this impact does not affect the Group's equity or solvency, as the losses were already included at this date.

In 2017 the Group has continued to strengthen its capital position with two new issuances classified as additional Tier 1 (contingent convertible) for €500m and USD 1.0 billion, respectively (the latter issued in the U.S. market, with a prospectus registered with the Securities and Exchange Commission (SEC), for which as of December 31, 2017 authorisation had still not been received for inclusion in the Group's capital ratios. This authorisation was finally received at the start of 2018).

At Tier 2, in 2017 BBVA, S.A. issued subordinated debt for a value of approximately €1.5 billion. In addition, Garanti Bank issued Tier 2 capita for USD 750, pending supervisory confirmation for its inclusion in the Group's regulatory ratios; the impact of this issue was of an additional +10 bps of Tier 2 as of December 31, 2017.

It is worth mentioning that during 2017, senior non-referred debt was issued for €1.79 billion, strengthening the Group's capacity to absorb losses and aiming to comply with the minimum requirement for own funds and eligible liabilities (MREL)

Lastly, the total phased-in ratio stood at 15.37%, for the reasons explained above.

In addition, the Group is pending information from the ECB of an update in the methodology of calculating exchange-rate risk. As of December 31, 2017 it would have had a positive impact of 4 bps on the fully-loaded CET1 ratio.

Fully-loaded CET1 ratio by year

(1) Other effects include mainly the balance of eligible minority interests, regulatory deductions and market value of the available-for-sale portfolios.

These capital levels are above the requirements established by the ECB in its SREP letter and the systemic buffers applicable to BBVA Group for the CET1 ratio in 2017 (11.125%).

With respect to changes in risk-weighted assets, a reduction was recorded of around 7% with respect to December 2016, largely due to the depreciation of currencies against the euro and an efficient management and assignment of the Group's capital in line with its strategic objectives.