Staff information

Team management

BBVA’s most important asset is its team: the people who make up the Group. That is why one of BBVA’s six Strategic Priorities is a first-class workforce.

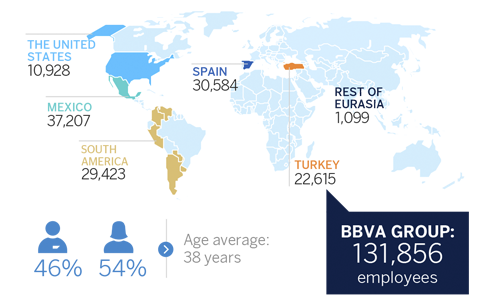

As of December 31, 2017, BBVA Group had 131,856 employees located in over 30 countries, 54% of them women and 46% men. The average age of the workforce was 37.5 years. The average length of service in the Organization was 10.2 years, with a staff turnover of 7.3% over the year.

BBVA Group (December 2017)

In 2017, the number of the Group employees decreased (down 2,936). This reduction was due, to a large extent, to the transformation plans of the distribution model that are being carried out in countries, such as in Turkey, and to the efficiency plans that are being carried out in South America, within the framework of the current legislation in each country.

Over the last few years, BBVA Group has been incorporating talent from a series of capacities that were not usual in the financial sector, but which are key in the new era in which the Group is operating (specialists in data, customer experience, etc.). In addition, to accompany the transformation process, a new, more transversal, transparent and effective people management model is being developed, so that each employee may occupy the role that best suits his or her profile and contribute the greatest value to the Organization, with the greatest commitment, and training and growing professionally

There has also been a transformation in ways of working over the last year, moving toward an agile model of organization, where the teams are responsible end to end for everything they do; constructing everything based on customer feedback and focusing on delivering solutions that best satisfy current and future customer needs.

BBVA understands corporate culture as a set of values, beliefs, policies, practices and conducts that are shared by the people in the Organization and that generate characteristics of identity differentiating it from other companies. This has been done by implementing the Our Values project.

For further information on the process of identifying and defining the three Values, see the section Our Values in the Strategy section.

Professional development

In the current context of transformation in the financial industry, all the evidence from the market demonstrates that the differential factor for assuming change is the people who form part of the organization. It is therefore crucial to have the best professionals available and to be capable of retaining them.

To achieve so, in 2016 a project was launched to create a new people management model in BBVA that allows it to guarantee the best professionals were available for each role: those capable of generating the greatest value, the most committed, those who could grow and learn; and that this should be possible with greater flexibility in managing the professional careers of employees, contributing greater transparency, simplicity and consistency. In 2017 the definition of the model was completed, and its implementation began through a number of pilot projects across the whole Group, reaching around 40,000 employees. The new model puts the BBVA employees at the center of their professional development, so that they have the tools allowing them to measure all their capabilities, detect whether there is an area for improvement and identify their growth opportunities within the Bank.

Selection and development

Throughout 2017, BBVA worked on transforming the Group’s selection model with the aim of attracting and selecting the talent needed in the different units to provide the best possible experience to all those involved in the process, without giving up the levers of equal opportunities and objective criteria in processes of assessing what is required in specific job positions.

The transformation of this model means, generating a global framework of reference that provides uniform support to all the geographic areas in which the Group operates, and also enrichment of the teams with the incorporation of new professionals who arrive from talent communities that the Bank wants to attract. The use of technology and the implementation of new tools allow to streamline and standardized the selection processes, whose decisions are based on data analysis

Thanks to the brand positioning actions and the launch onto the market of the professional options available in BBVA, more than 321,000 candidates have been attracted, of whom 57% were women and 43% men; and 75% were young people under the age of 30.

Over the year 19,151 professionals were incorporated into the Group, of whom 51% were young people under the age of 30.

The internal mobility model also experienced an important evolution aimed at putting the focus on the employees, implementing new policies based on transparency, trust and flexibility that will have to contribute to increase internal mobility, between areas and geographies, of the people who are part of BBVA.

Training

The strategic training agenda has put the emphasis on developing innovative initiatives that provide professionals with continuous learning, in such a way the new capacities and talent needed are developed to meet the challenges posed by the Bank’s transformation. In 2017 online has been consolidated as the main channel in this respect, with 65% of the training given through it, making it possible to give an average of 39 hours of training per employee.

A special effort has also been made to structure a digital offering segmented by levels and available for the whole workforce. Around 11,500 employees around the world have taken part in the Design Thinking and Agile programs in their different forms. The course on Security in information teaches employees to detect possible cyber threats when processing information on mobile devices. This course has been taken for more than 21,000 professionals, in other words, 16% of the workforce.

Basic training data (BBVA Group)

| 2017 | 2016 | |

|---|---|---|

| Total investment in training (million euros) | 52.2 | 45.5 |

| Investment in training per employee (euros)(1) | 396 | 337 |

| Hours of training per employee(2) | 39 | 39 |

| Employees who received training (%) | 84 | 91 |

| Satisfaction with the training (rating out of 10) | 8.6 | 8.8 |

| Subsidies received from FORCEM for training in Spain (million euros) | 3.1 | 2.7 |

Note: excluding Turkey in 2016, except for Investment in training.

- (1) Ratio calculated considering the Group’s workforce at closing.

- (2) Ratio calculated considering the workforce of BBVA with access to the training platform.

With respect to the legal requirements of the MiFID II (Markets in Financial Instruments Directive) on the knowledge required by employees who distribute information or advise on financial products and services in the european area, it is worth noting that 12,682 professionals are officially certified in Spain in the different forms authorized by the EFPA (DAF/EIP, EFA and EFP).

Self-development, which makes each employee responsible for his or her training experience, has meant the design of technological solutions in mobility that adapt to when, how and where employees can choose to receive training. This has allowed specialized training resources to be made available openly to all, as a result of integration with external digital content platforms, thus accounting for more than 76,000 training hours.

Diversity and inclusion

BBVA is committed to diversity in its workforce as one of the key elements to attract and retain the brightest talent and offer the best possible service to its customers. This diversity, understood in the broadest sense, includes not only gender diversity but also generational, experiential, racial, ethnic and geographic diversity (among others).

In terms of gender diversity, women account for 54% of the Group’s workforce. Women are in 48% of management positions, 31% of technology and engineering and 58% of the business and profit generating jobs.

To give greater external and internal visibility to women who are key in their areas of responsibility, as well as providing incentives and supporting local initiatives in favor of gender equality, the initiative Women@ BBVA was launched in 2017. It has given the chance to get to know BBVA professionals whose career paths have made them models both inside and outside the bank. A series of interviews sets out their main professional challenges, their leadership style, what characteristics they value most in their colleagues and why BBVA is an excellent place to develop their professional aspirations.

Meanwhile, BBVA continues to demonstrate its commitment to ensure the labor integration of people with different capabilities through the Plan Integra, which was conceived with the belief that employment is an essential pillar in achieving equal opportunity for everyone.

Progress is also being made on making the branches of the different banks making up the Group more accessible. The corporate headquarters of BBVA in Madrid, BBVA Bancomer in Mexico, BBVA Francés in Argentina and BBVA Chile are all accessible.

Workplace

BBVA conducts a general survey to measure the employees’ commitment and to know their opinions. In 2017, the percentage of employee participation that BBVA has throughout the world was 87%, 13 points more than in 2016. One of the highlights of the results is the average of the 12 main questions of the survey, which was 4.02 out of 5, which represents an increase of 0.11 points with respect to 2016. Finally, the level of commitment of BBVA employees increased from 3.7 in 2016 to 4.4 in 2017. This improvement has been possible thanks to the more than 11,000 action plans that were agreed as a result of the previous year’s survey.

Freedom of association and representation

In accordance with the different regulations in force in countries in which BBVA operates, the employment rights and conditions are included in the standards, agreements and arrangements subscribed, in this instance, with the corresponding employee representatives.

On matters of freedom of association and labor union representation, BBVA always aims for solutions via consensus. It places a very high value on dialog and negotiation as the best way of resolving any conflict in accordance with the pertinent local regulations in force where BBVA has its global footprint.

In BBVA Spain, the collective agreement for the banking sector is applicable to 100% of the workforce. There are also company agreements that complement and develop the provisions of this agreement and are signed with the labor unions representatives. Labor union representatives sitting on company committees are elected every four years by personal, free, direct and secret vote and are informed of any relevant changes to the organization of work in the Bank, as provided for by the pertinent legislation currently in force.

Occupational health and safety

BBVA considers the promotion of health and safety as one of its basic principles and fundamental goals, which is served by means of the continuous improvement of working conditions.

The occupational risk prevention model in BBVA in Spain is a participative one, based on the right of workers to consult and participate, through their representatives in matters related to health and safety at work. Its application reaches 100% of the workforce throughout Spain

The safety policy in Spain is carried out through the Occupational Risk Prevention Service, with activities such as the periodic assessment of occupational risks at work, specific assessment of workstations, the implementation of emergency and evacuation plans and coordination of preventive activities. It is also responsible for monitoring the health of workers through medical checkups, protecting vulnerable workers and adapting workstations with specific ergonomic material. In 2017 activities and campaigns were organized to improve the health of workers.

Occupational health (Spain)

| 2017 | 2016 | |

|---|---|---|

| Technical preventive actions | 2,655 | 2,420 |

| Preventive actions to improve working conditions | 3,429 | 2,981 |

| Appointments for health checks | 18,471 | 15,100 |

| Employees represented in health and safety committees (%) | 100 | 100 |

| Absenteeism rate (%) | 2.6 | 2.4 |

BBVA Occupational Health received recognition for good business practice in health promotion by the National Institute for Health and Safety at Work (INSHT), which complies with the requirements of the European Network for Workplace Health Promotion.

In Mexico, a number of campaigns were run in 2017 to promote awareness and prevention in occupational health and safety.

In Turkey a software was developed to manage all the processes related to occupational health and safety (OHS): risk assessment, monitoring of employee health, training programs, OHS unit committees, accidents at work, etc.

Argentina incorporated new workshops to the range of schemes for employees to promote healthy habits. In Colombia, promotion and prevention activities were carried out focused on the needs detected in the results of periodic medical examinations and the analysis of absenteeism. And in Venezuela the Integrated Health Center remained active, with periodic medical checkups have been given to nearly 1,000 workers.

Volunteer work

The BBVA Corporate Volunteering Policy manifests BBVA’s pledge to activities of this type and provides employees with conditions for engaging in corporate volunteer actions that generate a positive social impact. The policy is applied in all countries.

The activities of corporate volunteering enhance the professional development of employees, channeling their spirit of solidarity, and allowing them to make a personal contribution of their time and knowledge to provide help for people who need it most. This improves self-esteem, increases the sense of pride in belonging to the company and thus has an effect on talent attraction and retention. It also generates a positive impact at the level of corporate social responsibility of the company.

In 2017, nearly 8,000 employees took part in volunteering actions. These corporate volunteering activities are designed to boost initiatives arising from the employees themselves or coordinated by BBVA, in connection with education, primarily to boost financial education and thus support the strategic lines set out in the responsible banking model.