Introduction

About BBVA

BBVA is a customer-centric global financial services group founded in 1857. Its Purpose is to bring the age of opportunity to everyone. This Purpose reflects the Entity’s role as enabler, to offer its customers the best banking solutions, helping them make the best financial decisions and making a true difference in their lives. We live in the era of opportunities, where technology offers universal access to education and offers many more people than ever before the possibility of embarking on projects and chasing their dreams. BBVA helps people make their dreams come true.

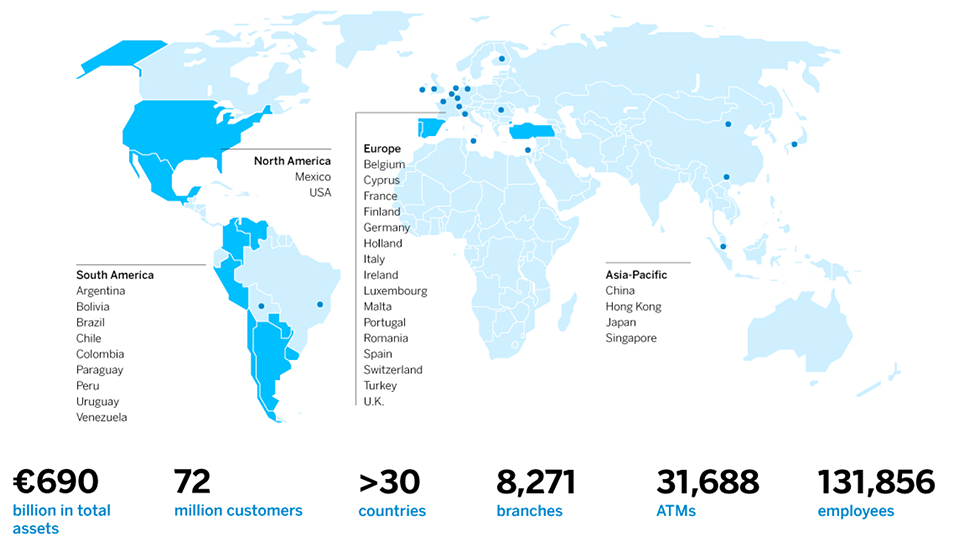

BBVA operates in more than 30 countries. The Group has a solid position in Spain, it is the largest financial institution in Mexico and leading franchises in South America and the Sunbelt Region of the United States. It is also Turkish bank Garanti’s leading shareholder. Its diversified business is biased to high-growth markets and it relies on technology as a key sustainable competitive advantage.

BBVA has a responsible banking model based on seeking out a return adjusted to principles, legal compliance, best practices and the creation of long-term value for all its stakeholders.

Business organizational chart and structure

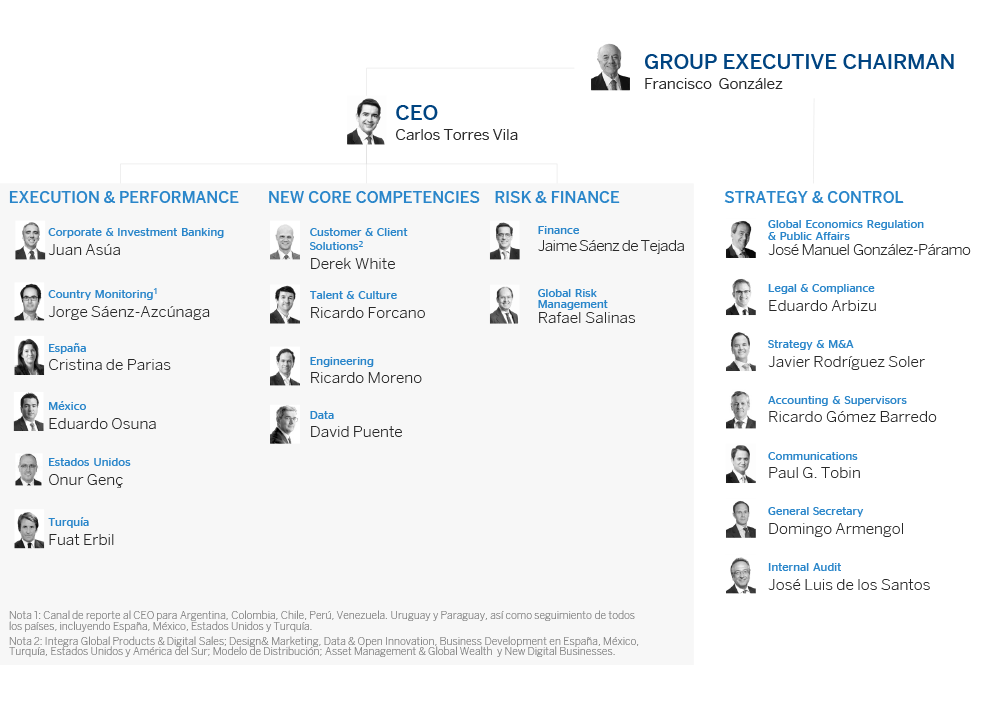

BBVA Group’s organizational structure has remained the same in 2017, with only one change: the creation of the global Data area. This area, which answers directly to the CEO, has been created to boost the strategic use of data in all areas of the Bank. It thus defines and implements the global data strategy, as well as creating and extending a data culture in the Bank, with the aim of speeding up BBVA’s transformation to a data-driven organization.

BBVA’s organizational structure remains divided into four types of areas: Execution & Performance, New Core Competences, Risk & Finance and Strategy & Control. The CEO is responsible for the first three functions and the Group Executive Chairman for Strategy & Control.

Environment

Macroeconomic environment

Global economic growth held steady at around 1% quarter-on-quarter in the first nine months of 2017 and latest available indicators suggest a continuation of this momentum in the last part of the year. Confidence data continues to improve, accompanied by a recovery in world trade and the industrial sector, while private consumption remains robust in developed countries. This positive trend reflects an improved economic performance across all regions. With respect to advanced economies, US GDP increased slightly more than expected in 2017 (up 2.3%), alleviating doubts about the sustainability of growth rates over the coming quarters. In Europe, the pickup in growth in recent quarters (up 2.5% in 2017) can be explained by a strengthening of domestic demand. Among emerging economies, growth in China is set to remain supportive for the rest of Asia. Alongside favorable market conditions, this will give increased impetus to Latin American countries. Finally, with their recovery, Russian and Brazilian economies are no longer hampering global growth. Accordingly, and in contrast to other post-financial crisis periods, there has been a global synchronous recovery.

This growth environment has been accompanied by moderate levels of inflation, despite ample liquidity in the markets. As a result of the above, central banks have more room for maneuver in emerging economies to continue using monetary policy to support growth, while allowing monetary authorities in advanced economies to maintain a cautious approach to implementing monetary policy normalization.

Other factors which have contributed to the upbeat global picture, such as generally neutral or somewhat expansive fiscal policy and moderate commodity prices, look likely to remain in place over the coming quarters. Global growth is therefore forecast to accelerate to around 3.7% in 2017.

Global GDP growth and inflation in 2017 (Real percentage growth)

| GDP | Inflation | |

|---|---|---|

| Global | 3.7 | 6.2 |

| Eurozone | 2.5 | 1.5 |

| Spain | 3.1 | 2.0 |

| The United States | 2.3 | 2.1 |

| Mexico | 2.3 | 6.0 |

| South America(1) | 0.8 | 65.3 |

| Turkey | 7.0 | 11.1 |

| China | 6.9 | 1.5 |

- Source: BBVA Research estimates.

- (1) It includes Brazil, Argentina, Venezuela, Colombia, Peru and Chile.

Digitalization and changing consumer behavior

Digital activity is outpacing growth in overall economic activity. Society is changing in line with the exponential growth in technology (internet, mobile devices, social networks, cloud, etc.). As a result, digitalization is therefore revolutionizing financial services worldwide. Consumers are altering their purchasing habits through use of digital technologies, which increases their ability to access financial products and services at any time and from anywhere. Greater availability of information is creating more demanding customers, who expect swift, easy and immediate responses to their needs. And digitalization is what enables the financial industry to meet these new customer demands.

Technology is the lever for change which allows the value proposition to be redefined to focus on customers’ real needs. The use of mobile devices as the preferred and often only tool for customers’ interactions with their financial institutions has changed the nature of this relationship and the way in which financial decisions are made. It is crucial to offer customers a simple, consistent and user-friendly experience, without jeopardizing security and making the most of technological resources.

Data are the cornerstone of the digital economy. Financial institutions must make the most of the opportunities offered by technology and innovation, analyzing customer behavior, needs and expectations in order to offer them personalized, added-value services. The development of algorithms based on big data can lead to the development of new advisory tools for managing personal finances and access to products which until recently were only available to high-value segments.

The digital transformation of the financial industry is boosting efficiency through automation of internal processes, with the use of new technologies to remain relevant in the new environment, such as blockchain and the cloud; data exploitation; and new business models (platforms). Participation in digital ecosystems through alliances and investments provides a way to learn and take advantage of the opportunities emerging in the digital world.

The financial services market is also evolving with the arrival of new players: companies offering financial services to a specific segment or focused on a part of the value chain (payment, financing, etc.). These companies are digital natives, rely on data use and offer a good customer experience, sometimes exploiting a laxer regulatory framework than that for the banking sector.

The regulatory environment

1. Completion of Basel III

The main issue in developing the global regulatory agenda in 2017 has continued to be the completion of the pending elements in the global capital framework (Basel III), in particular the comparability of the internal models used by global banks and the variability of risk-weighted assets.

At European level the regulatory effort was focused on the European Council’s discussion of the Commission’s proposal to review the European banking framework with the aim of incorporating the final elements of Basel III to reduce the risks to the financial system.

2. Bank resolution in Europe

In terms of legislative development, in 2017 a new class of bank liabilities were created called senior non-preferred debt, by the transposition of an EU Directive through Royal Decree Law (RDL) 11/2017. A number of banks, including BBVA, have begun to issue this new class of debt, which has had an excellent uptake by institutional investors.

In addition, discussions are continuing between the EU Council and Parliament about the Commission’s 2016 proposal on a series of banking reforms to mitigate the risk of the banking sector. The most important of these is the implementation of international law on the total loss-absorbing capacity (TLAC) of systemic banks in Europe. The Commission has proposed modifying the minimum requirement for own funds and eligible liabilities now in force (MREL) and align it with the TLAC.

At the same time, the resolution authority of the main banks in the Eurozone, the Single Resolution Board (SRB) issued at the end of 2017 the first mandatory MREL requirements and defined a calendar for compliance based on current law.

3. Current situation on the banking union in Europe

Following the consolidation of the economic recovery in Europe, the debate on the future of the euro has resulted in the issue of two important documents by the European Commission. The first is a White Book on possible scenarios for the future integration of Europe, with a list of options. The core or most likely framework according to the document is a future two-speed Europe. The second document is a Reflection Paper on the future of the Eurozone, which proposes moving forward in two phases (2017-19 and 2019-25) toward a more consolidated union.

It is important to highlight that the banking union has meant: i) application of a single regulation; ii) the creation of the Single Supervisory Mechanism (SSM); and iii) the creation of the Single Resolution Mechanism (SRM) and the Single Resolution Fund (SRF). Two fundamental elements have yet to be established for full banking union: a common public backstop for the SRF and a common European deposit insurance scheme (EDIS).

4. Focus on reducing non-performing loans

The European authorities have expressed their concern regarding non-performing loans (NPLs) in the EU. In 2017 a number of initiatives were implemented, focused on three areas:

- Improved supervision

The European Commission is considering the introduction of prudential requirements for new loans in its review of the CRR/CRD capital Directives. - Reform of the insolvency frameworks

The Commission published the results of a comparative study carried out among countries and a consultation on the introduction of a faster loan recovery guarantee, within the framework of the directive proposed in 2016 on insolvency frameworks. - Development of secondary markets for non-performing loans

In January 2017, the European Banking Authority (EBA) presented its proposal for the creation of an asset management company at European level (the “bad bank”). More recently, the Council’s action plan invited the European Commission to issue a guide for countries to create their own bad banks.

The Council’s action plan invited authorities to propose initiatives related to transparency, including the creation of centralized NPL data platforms, to facilitate access to this information. The securitization of NPLs could be another tool to withdraw the most granular loans from the balance sheets.

5. Regulation in the field of digital transformation of the financial sector

Several topics marked the regulatory agenda in the field of digital transformation of the financial sector in 2017:

- The payments industry. In January 2018 the new Payment Services Directive (PSD2) came into force. This new regulatory framework aims to promote competition and strengthen the security of payments in Europe. To do so, it regulates third-party access to customers’ payment accounts.

- Digitalization makes possible the storage, processing and exchange of large volumes of data. This trend makes it easier to adopt technologies such as big data and artificial intelligence, with an enormous potential for expanding access to financial services; but it also generates concerns on how to ensure privacy and the integrity of customer data. In Europe this has resulted in two regulations: the General Data Protection Regulation (GDPR), which entered into force in 2018, and the proposed e-Privacy Regulation, still at the discussion phase.

- In view of the growing importance of data, it is important to guarantee the integrity of information. The increased frequency and sophistication of cyberattacks make cybersecurity a priority for the financial sector. A new cybersecurity framework was created in Europe through the Security Directive for Networks and Information Systems (NIS), GDPR and PSD2.

Finally, in 2017 there were more intense regulatory discussions on the implications of the technological innovation in financial services or fintech Operational, IT and cyber risks are among the greatest concerns for the authorities, together with possible risks for financial stability derived from financial technology (fintech) in the sector. There is a need to assess whether the existing regulatory frameworks are capable of guaranteeing a level playing field and adequate consumer protection.

Economic outlook

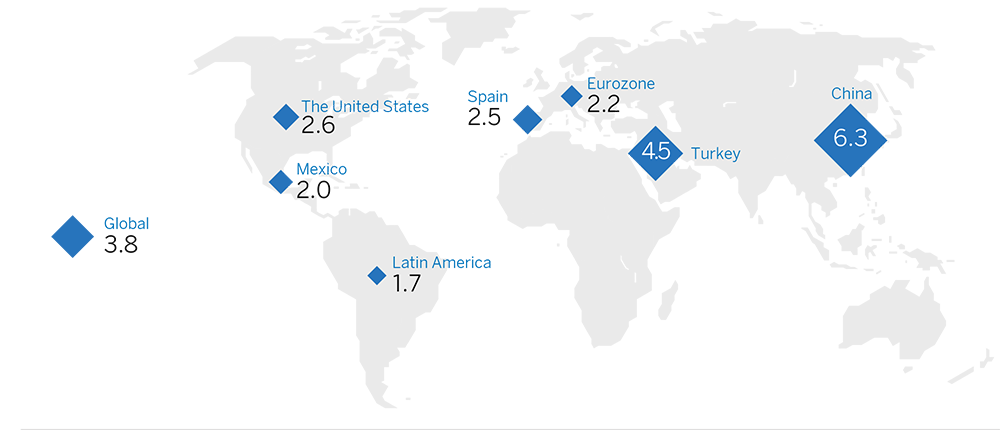

The underlying factors which have supported the rebound and stabilization of global growth since the end of 2016 will continue into 2018, although some may begin to gradually fade. The most immediate factor will be the gradual normalization of Federal Reserve (Fed) and ECB monetary policy, which will involve a gradual tightening of global liquidity and a reduction in incentives for capital flows toward emerging economies. BBVA Research forecasts global growth to remain relatively stable at around 3.8%, also in 2018. However, various political risks could affect economic confidence and market performance.

In Spain, the recovery is likely to slow in 2018 to around 2.5% following three consecutive years of growth in excess of 3%. The main support factors will be positive momentum in activity and employment data, a favorable global backdrop which should remain propitious for goods exports, and an expansive monetary policy. However, the recent rise in uncertainty which may be sustained for some time represents a risk to certain components of demand, primarily investment and services exports.

In the rest of Europe, improving labor markets and increased confidence, alongside favorable financing conditions, will continue to underpin momentum in consumption and investment. However, some external support factors could gradually attenuate over the course of the year 2018. Euro appreciation, rising commodity prices and stabilization of global growth mean GDP could slip slightly above 2% in 2018 (up 2.5% in 2017). In this context, the ECB intends to rein in its asset purchases, while interest-rate hikes likely to be postponed until mid-2019. Furthermore, domestic risks within the Eurozone, which are primarily political, remain tilted to the downside, though they have moderated to some degree.

In the United States, uncertainty regarding economic policy has been reduced in recent quarters. Economic fundamentals and the effect of the recently adopted measures are consistent with a growth of a shade over 2.5% in 2018. Robust global growth, dollar depreciation, oil price expectations and the moderate improvement in construction should spur an upturn in investment. By contrast, a more gradual improvement in the labor market and stronger inflation could weigh against private consumption. However, contained price growth in recent months and the absence of clear signs of inflationary pressure mean that it is likely that the Fed will proceed slowly in its process of normalizing monetary policy.

Despite the improvement in the global economy, some of the remnants of the recession still need to be absorbed and concerns linger regarding the capacity to increase the rate of long-term potential growth. Therefore, how the authorities go about withdrawing the stimuli, particularly on the monetary policy side, continues to be crucial for entrenching the recovery in developed economies and ensuring financial markets remain favorable for emerging countries. By contrast, maintaining low interest rates for a prolonged period of time could contribute to increasing medium-term financial vulnerabilities.

In emerging economies, the key challenge is to manage the potential vulnerability to possible abrupt fluctuations in capital flows in a context of greater idiosyncratic uncertainty, whether as a result of geopolitical tensions or due to the elections taking place in 2018, particularly in Latin America. In Turkey, the credit stimulus driven by the authorities is pushing GDP growth above potential. This, alongside the exchange-rate impact, has led to a significant increase in inflation to around 12% in the last quarter of 2017, which has provoked a tightening of monetary policy. To the extent that the effect of the credit stimulus proves temporary, growth is forecast to slow to 4.5% in 2018. The Mexican economy could post growth of around 2% in 2018 (from 2.3% in 2017), with the main risk stemming from a possible deterioration in trade relations with the United States. The recovery is set to gain traction in South America as whole. GDP could grow at around 1.6% in 2018, following on from 0.8% in 2017, on the back of support from the external sector, Brazil’s recovery from recession, private and public investment in Argentina and infrastructure investment plans in countries such as Colombia and Peru.

Although short-term risks have receded, especially in China, the latter’s economic imbalances remain the biggest threat to the global economy over the medium and long-term. Support from the Chinese authorities has helped stabilize growth in 2017 (6.9%). Although concerns of a hard landing in the short term have diminished, growth is nonetheless expected to continue around 6.3% in 2018.

Expected economic growth in 2018 (Percentage of GDP growth)

Source: BBVA Research

Latin America: Argentina, Brazil, Chile, Colombia, Mexico, Peru and Venezuela