Highlights

Results and business activity

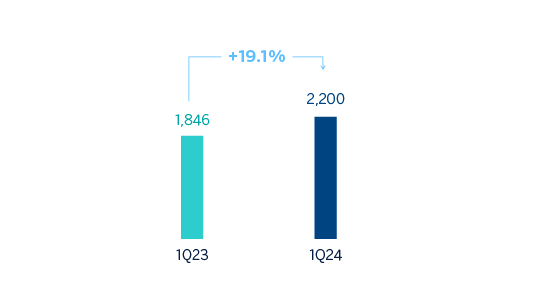

The BBVA Group generated a net attributable profit of €2,200m between January and March of 2024, driven by the performance of recurring revenues of the banking business. Thus, the net interest income grew at a year-on-year rate of 15.4% and net fees and commissions by 31.1%. This result represents an increase of 19.1% compared to the same period of the previous year, 38.1% excluding the impact of the evolution of currencies.

These results include the recording of the total estimated annual amount of the temporary tax on credit institutions and financial credit institutions for €285m, included in the other operating income and expenses line of the income statement.

Operating expenses increased by 19.5% at Group level at constant exchange rates, affected by the inflation rates observed in the countries in which the Group operates. Thanks to the remarkable growth in gross income (+31.0%), greater than the growth in operating expenses, the efficiency ratio stood at 41.2% as of March 31, 2024, with an improvement of 398 basis points, in constant terms, compared to the ratio recorded 12 months earlier.

The provisions for impairment on financial assets increased (+40.7% in year-on-year terms and at constant exchange rates), with higher requirements linked to the growth in the most profitable segments, in line with the Group´s strategy.

Loans and advances to customers recorded an increase of 3.0% compared to the end of December 2023, particularly driven by the evolution of corporate loans (+3.2% at Group level), and by the positive performance of loans of all segments to individuals.

Customer funds increased by 6.4% compared to the end of the previous year, thanks to both the growth in deposits from customers, which increased by 5.6%, and to the increase in off-balance sheet funds, which grew by 8.5%.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2023)

Business areas

As for the business areas evolution, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

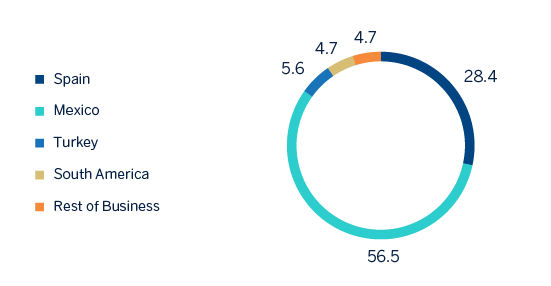

- Spain generated a net attributable profit of €725m in the first quarter of 2024, 36.5% higher than in the same period of the previous year, mainly supported by the favorable evolution of the net interest income. These solid results include the negative impact of €285m caused by the recording of the temporary tax on credit institutions and financial credit institutions.

- In Mexico, BBVA achieved a cumulative net attributable profit of €1,441m by the end of March 2024, representing an increase of 3.6% compared to the same period of the previous year, mainly as a result of the strength of the recurring income from the banking business.

- Turkey generated a net attributable profit of €144m during the first quarter of 2024, which compares positively with the accumulated result reached at the end of March 2023 at constant exchange rate, both periods reflecting the impact of the application of hyperinflation accounting.

- South America generated a cumulative net attributable profit of €119m at the end of the first quarter of 2024, which represents a year-on-year increase of +54.6%, driven by the good performance of recurring income (84.1%) and the area's NTI (net trading income).

- Rest of Business achieved an accumulated net attributable profit of €121m during the first quarter of 2024, 28.8% higher than in the same period of the previous year, favored by the performance of the net interest income and the NTI.

The Corporate Center recorded a net attributable loss of €-350m between January and March of 2024, which is an improvement compared with the €-515m recorded in the same period of the previous year.

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business, Corporate & Investment Banking (CIB), carried out by BBVA in the countries where it operates. CIB generated a net attributable profit of €668m between January and March of 2024. These results represent an increase of 40.0% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients.

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS)

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 1Q24)

(1) Excludes the Corporate Center.

Solvency

The Group's CET1 fully-loaded ratio stood at 12.82% as of March 31, 2024, which allows to keep maintaining a large management buffer over the Group's CET1 requirement (9.10%)1 and above the Group's established target management range of 11.5-12.0% of CET1.

1 This includes the update of the countercyclical capital buffer calculated on the basis of exposure at end December 2023.

Shareholder remuneration

Regarding shareholder remuneration, as approved by the General Shareholders´ Meeting on March 15, 2024, in its first item on the agenda, on April 10, 2024, a cash payment of €0.39 gross per each outstanding BBVA share entitled to receive such amount was made against the 2023 results, as an additional shareholder remuneration for the financial year 2023. Thus, the total amount of cash distributions for 2023, taking into account the €0.16 gross per share that was distributed in October 2023, amounted to €0.55 gross per share.

Total shareholder remuneration includes, in addition to the cash payments mentioned above, the remuneration resulting from the BBVA's buyback program for the repurchase of own shares announced on January 30, 2024 for a maximum amount of €781m, and which started being executed on March 1, 2024. By means of an Other Relevant Information notice dated April 9, 2024, BBVA announced the completion of the share buyback program upon reaching the maximum monetary amount, having acquired 74,654,915 own shares, between March 4 and April 9, 2024, representing, approximately, 1.28% of BBVA's share capital as of such date. The redemption of such shares is pending execution.

Sustainability

Channeling sustainable business

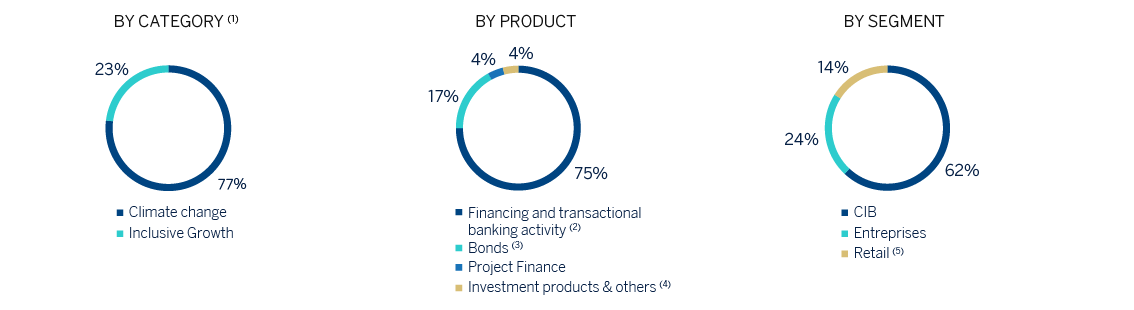

SUSTAINABLE BUSINESS BREAKDOWN (PERCENTAGE. TOTAL AMOUNT CHANNELED 2018-MARCH 2024)

(1) In those cases where it is not feasible or sufficient information is not available to allow an exact distribution between the categories of climate change and inclusive growth, internal estimates are made based on the available information.

(2) It fundamentally includes products whose funds are allocated to activities considered sustainable (in accordance with both internal and market standards, existing regulations and best practices), as well as products linked to sustainability (in accordance with both internal and market and best practices), such as those linked to environmental and/or social indicators.

(3) Bonds in which BBVA acts as bookrunner.

(4) Investment products art.8 or 9 under SFDR or similar criteria outside the EU managed, intermediated or marketed by BBVA. "Other" includes deposits under the Sustainable Transaction Banking Framework until its replacement by the CIB Sustainable Products Framework (both Frameworks published on the bank's website), insurance policies related to energy efficiency and inclusive growth and electric vehicle autorenting, mainly.

(5) Includes the activity of the BBVA Microfinance Foundation (BBVAMF), which is not part of the consolidated Group and which has channeled around €8 billion in the period from 2018 to March 2024 to support vulnerable entrepreneurs with microcredits.

Regarding the objective of channeling €300 billion between 2018 and 20252 as part of the sustainability strategy, the BBVA Group has mobilized an approximate total of €226 billion in sustainable business between 2018 and March 2024, of which approximately 77% corresponds to the area of promoting the fight against climate change and the remaining 23% to promote inclusive growth. The amount channeled includes financing, intermediation, investment, off-balance sheet and insurance transactions. These operations have contractual maturity or amortization dates, so the above mentioned accumulated figure does not represent the amount reflected on the balance sheet.

During the first quarter of 2024, approximately €20 billion were mobilized (+41% compared with the same period of the previous year).

In this first quarter, retail business has been mobilized for an amount of around €2.6 billon. During this quarter, BBVA has continued to promote customized digital solutions aimed at the mass consumer market, offering retail customers a vision of the potential savings they can obtain by adopting energy-saving measures in their homes and transportation. It is worth highlighting the good performance of the channeling related to the acquisition of hybrid or electric vehicles with €124 million, which represents a growth of 136% compared to the same period of the previous year.

Between January and March 2024, the commercial business (enterprises) mobilized around €7 billon. This quarter, the unit continued to advise corporate clients on sustainable solutions that enable economic savings by focusing on cross-cutting issues such as energy efficiency, car fleet renewal and water. In this regard, it is worth highlighting the financing allocated to agribusiness, water and circular economy with €700m, representing an increase of 258% year-on-year. In this area, Mexico's contribution is fundamental, as it accounts for about half of this channeling.

CIB has channeled around €10.4 billion during the first quarter of 2024, with a positive performance in all products, both long and short-term financing and the intermediation of green, social, sustainable and environmental and/or social indicators-linked bonds in which BBVA acts as bookrunner. During the quarter, BBVA has continued to promote in the wholesale segment the financing of clean technologies and of renewable energy projects as well as confirming linked to sustainability, among other strategic lines. In terms of channeling, the financing of renewable energy projects stands out, contributing around €800m during this quarter and more than doubling compared to the same period of the previous year.

Relevant advances in the field of sustainability

- TCFD

In March 2024, BBVA published its fifth TCFD (Task Force on Climate-Related Financial Disclosure) report, which summarizes its strategy to manage the risks and opportunities related to climate change, as well as the measures it is taking in this regard. The Group has continued to incorporate the elements of a Transition Plan, applying the guides and recommendations for financial institutions published by Glasgow Financial Alliance for Net Zero (GFANZ) in November 2022. - Target presence of women in management positions by 2026

To promote gender equality, in 2022 BBVA set a target of 35% women in management positions by 2024. After achieving an indicator of 34.7% in 2023, in February 2024 a new target was announced for the next 2 years, so that BBVA aims to have 36.8% of women in management positions by the end of 2026.

This indicator, which measures the evolution of the representation of women in management positions in the Group, is included in the long-term variable incentives for executive directors and senior management. - Issuance of a green bond

In March 2024, BBVA issued a senior preferred green bond in the amount of €1,000m, maturing in 7 years and at a price set at mid swap plus 90 basis points. For this new issue, projects financed during the 6 months prior to the bond issue have been identified and divided into two eligible categories according to BBVA's Sustainable Debt Financing Framework: renewable energy and clean transportation. - Sustainability forums

On February 29, 2024, the third edition of the BBVA Sustainability Forum was held in BBVA City. The event, which welcomed more than 400 attendees including representatives of the Public Administration, personalities and global companies and institutions very active in the fight against climate change and the promotion of inclusive growth, has become a reference event for the high-level dialogue on the economic and social challenges of sustainability.

On March 20, 2024, the first edition of the BBVA Sustainability Summit in Peru took place in Lima. A space that brought together more than 500 attendees including clients, businessmen, representatives of institutions and important local and international personalities from the world of sustainability at the bank's headquarters. At the meeting, experiences, strategies and sustainable practices were shared with the aim of informing, raising awareness and mobilizing about the challenges and opportunities that sustainability represents for the private sector.

2 For the purposes of the 2025 goal, channeling is considered as any mobilization of financial flows, on a cumulative basis, in relation to activities, customers or products considered sustainable or that promote sustainability primarily in accordance with internal standards inspired by existing regulations, market standards such as the Green Bond Principles, the Social Bond Principles and the Sustainability Linked Bond Principles of the International Capital Markets Association, as well as the Green Loan Principles, Social Loan Principles and Sustainability Linked Loan Principles of the Loan Market Association, existing regulations and best market practices. The foregoing is without prejudice to the fact that such mobilization, both initially and at a later time, may not be recorded in the balance sheet. To determine the amount of sustainable business channeled, internal criteria are used based on both internal and external information, whether public, provided by customers or by a third party (mainly data providers and independent experts).