Highlights

Results and business activity

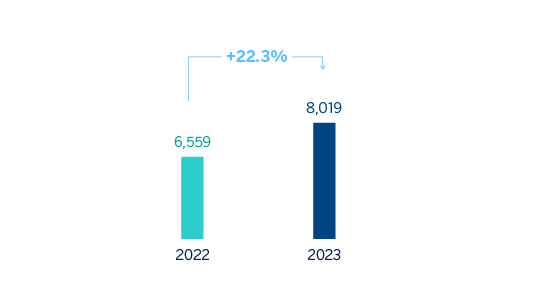

The BBVA Group generated a net attributable profit of €8,019m between January and December of 2023, boosted by the performance of recurring income of the banking business, mainly the net interest income. This result means an increase of 22.3% compared to the previous year, excluding the net impact arisen from the purchase of offices in Spain in 2022 from the comparison. These results include the recording for the total annual amount paid for the temporary tax on credit institutions and financial credit institutions for €215m, included in the other operating income and expenses line of the income statement.

Operating expenses increased by 19.7% at Group level at constant exchange rates, largely impacted by the inflation rates observed in the countries in which the Group operates. Thanks to the remarkable growth in gross income (+30.3%), higher than the growth in expenses, the efficiency ratio stood at 41.7% as of December 31, 2023, with an improvement of 370 basis points, in constant terms, compared to the ratio recorded 12 months earlier.

The provisions for impairment on financial assets increased (+33.8% in year-on-year terms and at constant exchange rates), with lower requirements in Turkey, which were offset by higher provisioning needs, mainly in Mexico and South America, in a context of rising interest rates and growth in the most profitable segments, in line with the Group's strategy.

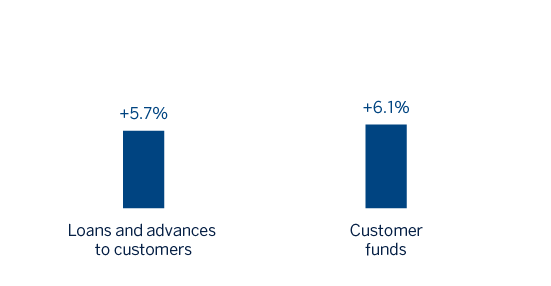

Loans and advances to customers recorded an increase of 5.7% compared to the end of December 2022, strongly favored by the evolution of retail loans (+7.2% at Group level). Customer funds increased by 6.1% compared to the end of the previous year, thanks to both the growth in deposits from customers, which increased by 4.8% and to the increase in off-balance sheet funds, which grew by 9.5%.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2022)

As for the business areas evolution, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

The Corporate Center recorded 2023a net attributable profit of €-1,607m between January and December of 2023, compared with €-922m recorded on the same period of the previous year, mainly due to a negative contribution in the NTI line from exchange rate hedges as a result of a better than expected currency performance, in particular, the Mexican peso during the first half of the year.

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €2,253m between January and December of 2023. These results, which do not include the application of hyperinflation accounting, represent an increase of 44.5% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients.

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS)

General note: 2022 excludes net impact arisen from the purchase of offices in Spain.

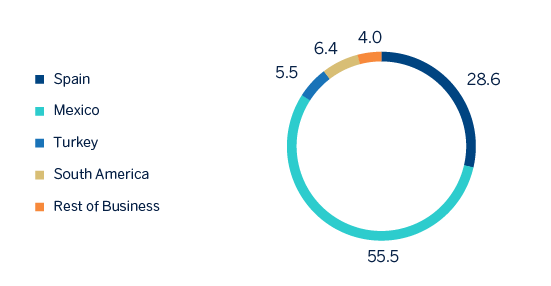

NET ATTRIBUTABLE PROFIT BREAKDOWN ⁽ (1)

(PERCENTAGE. 2023)

(1) Excludes the Corporate Center.

Solvency

The Group's CET1 fully-loaded ratio stood at 12.67% as of December 31, 2023, which allows to keep maintaining a large management buffer over the Group's CET1 requirement (8.78%)1 and above the Group's established target management range of 11.5-12.0% of CET1.

Shareholder remuneration

Regarding shareholder remuneration, a cash gross distribution in the amount of €0.39 per share on April as final dividend of 2023 and the execution of a new Share Buyback Program of BBVA for an amount of €781m, subject to the corresponding regulatory authorizations and the communication with the program specific terms and conditions before its effective start, are expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the year 2023 will reach €4,010m, a 50% of the net attributable profit, which represents €0.68 gross per share, taking into account the payment in cash of €0.16 gross per share paid in October 2023 as interim dividend of the year.

1 This includes the update of the countercyclical capital buffer calculated on the basis of exposure at end September 2023.