Highlights

Results and business activity

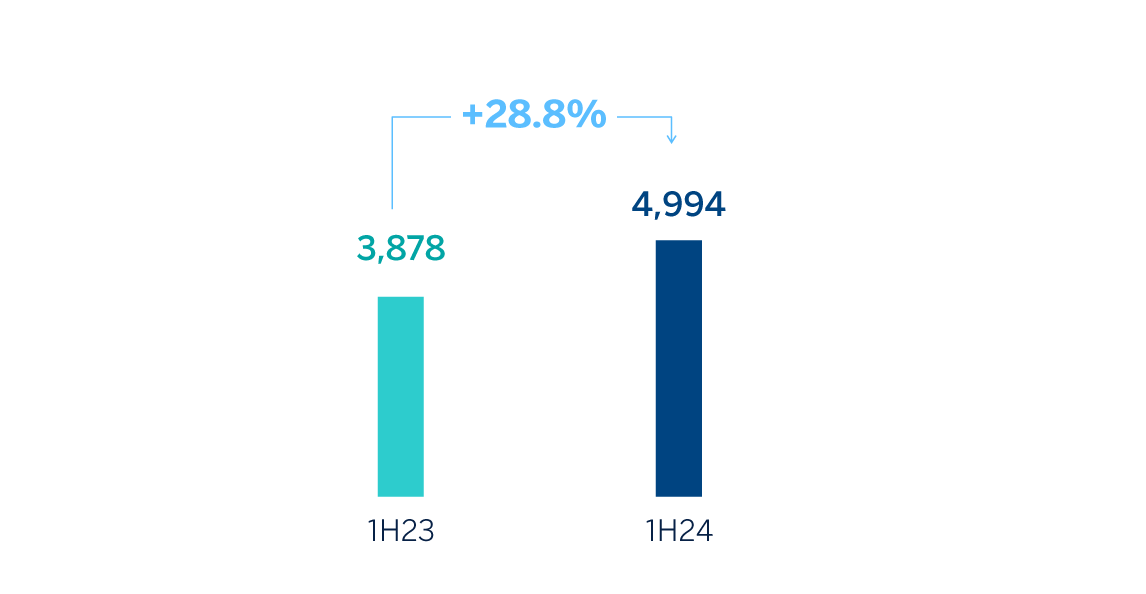

The BBVA Group generated a net attributable profit of €4,994m in the first half of 2024, again driven by the performance of recurring revenues of the banking business. Thus, the net interest income grew at a year-on-year rate of 13.9% and net fees and commissions by 32.1%. These results represent an increase of 28.8% compared to the same period of the previous year, 37.2% excluding the impact of the evolution of currencies.

Accumulated results at the end of the first half of 2024 include the recording of the total estimated annual amount of the temporary tax on credit institutions and financial credit institutions for €285m, included in the other operating income and expenses line of the income statement.

Operating expenses increased by 19.5% at Group level at constant exchange rates, affected by an environment of still high inflation in the countries where the Group has a presence, the growth of the workforce in most of them and the higher level of investments, in line with those made in recent years. Thanks to the remarkable growth in gross income (+30.5%, in constant terms), greater than the growth in operating expenses, the efficiency ratio stood at 39.3% as of June 30, 2024, with an improvement of 362 basis points, in constant terms, compared to the ratio recorded 12 months earlier, in constant terms.

The provisions for impairment on financial assets increased (+42.8% in year-on-year terms and at constant exchange rates), with higher requirements linked to the growth in retail products, the most profitable in line with the Group´s strategy.

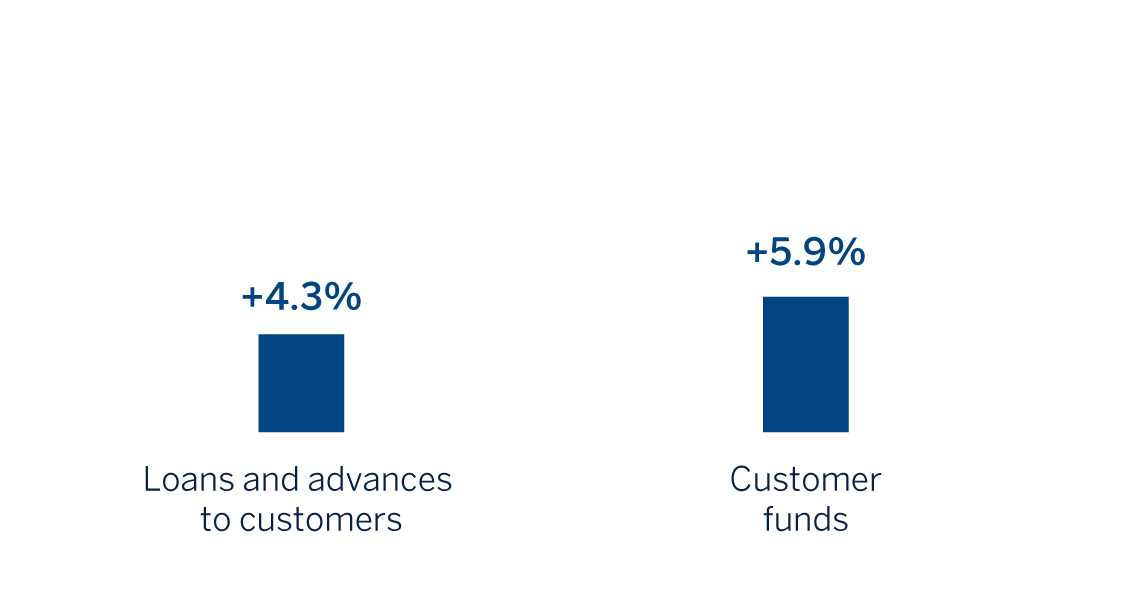

Loans and advances to customers recorded an increase of 4.3% compared to the end of December 2023, particularly driven by the evolution of corporate loans (+5.1% at Group level), and by the positive performance of loans of all segments to individuals.

Customer funds increased by 5.9% compared to the end of the previous year. This favorable performance was due to the growth in both deposits from customers, which increased by 4.2%, as well as in the evolution of off-balance sheet funds, that shows a greater dynamism and grew by 10.1%.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2023)

Business areas

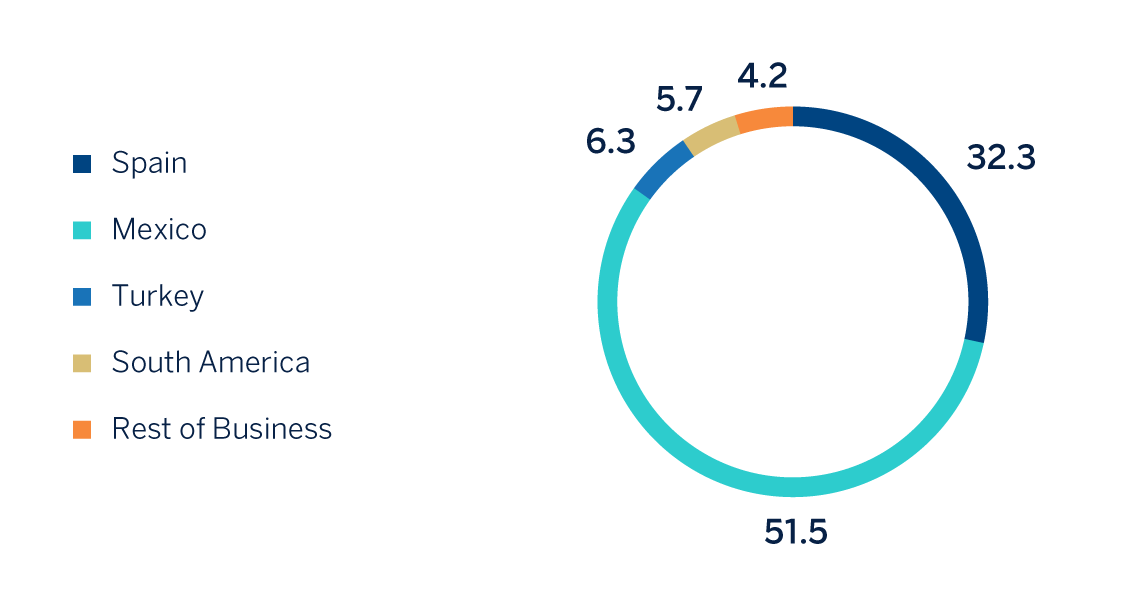

According to the accumulated results of the business areas at the end of the first half of 2024 and excluding the effect of currencies fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

- Spain generated a net attributable profit of €1,790m, that is 47.8% higher than in the same period of the previous year, mainly supported by the favorable evolution of every line item of the gross income. These solid results include the negative impact of €285m due to the recording of the estimated annual amount of the temporary tax on credit institutions and financial credit institutions.

- BBVA Mexico achieved a cumulative net attributable profit of €2,858m, representing an increase of 3.3% compared to the same period of the previous year, mainly due to the strength of the recurring income from the banking business.

- Turkey generated a net attributable profit of €351m, with an improvement in the contribution to the Group's results in the second quarter of the year.

- South America generated a cumulative net attributable profit of €317m, which represents a year-on-year increase of 99.7%, driven by the good performance of recurring income and the net trading income (hereinafter, NTI).

- Rest of Business achieved an accumulated net attributable profit of €235m, 8.3% higher than in the same period of the previous year, favored by the performance of the net interest income and the NTI.

The Corporate Center recorded a net attributable loss of €-557m, which is an improvement compared with the €-1,039m recorded in the same period of the previous year, mainly due to the evolution of the NTI.

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business, Corporate & Investment Banking (CIB), carried out by BBVA in the countries where it operates. CIB generated a net attributable profit of €1,396m. These results represent an increase of 23.9% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients.

NET ATTRIBUTABLE PROFIT

(LOSS)(MILLIONS OF EUROS)

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 1H24)

(1) Excludes the Corporate Center.

Solvency

The CET1 fully loaded ratio of the BBVA Group stood at 12.75% as of June 30, 2024, which allows maintaining a large management buffer over the Group's CET1 requirement as of that date (9.11%1), and which is also above the Group's target management range of 11.5 - 12.0% CET1.

Purchase offer to the Banco Sabadell shareholders

On April 30, 2024, due to a media report, BBVA published an inside information notice (información privilegiada) stating that it had informed the chairman of the Board of Directors of Banco de Sabadell, S.A. (the "Target Company") of the interest of BBVA’s Board of Directors in initiating negotiations to explore a possible merger between the two entities. On the same date, BBVA sent to the chairman of the Target Company the written proposal for the merger of the two entities. The content of the written proposal sent to the Board of Directors of the Target Company was published on May 1, 2024 by BBVA through the publication of an inside information notice (información privilegiada) with the CNMV.

On May 6, 2024, the Target Company published an inside information notice (información privilegiada) informing of the rejection of the proposal by its Board of Directors.

Following such rejection, on May 9, 2024, BBVA announced, through the publication of an inside information notice (información privilegiada) (the "Prior Announcement"), the decision to launch a voluntary tender offer (the "Offer") for the acquisition of all of the issued shares of the Target Company, being a total of 5,440,221,447 ordinary shares with a par value of €0.125 each (representing 100% of the Target Company’s share capital). The consideration offered by BBVA to the shareholders of the Target Company consists of one (1) newly issued share of BBVA for each four and eighty-three hundredths (4.83) ordinary shares of the Target Company (the "Consideration"), subject to certain adjustments in the case of dividend distribution in accordance with what was indicated in the Prior Announcement.

Pursuant to the provisions of Royal Decree 1066/2007, of July 27, on the rules governing tender offers ("Royal Decree 1066/2007"), the Offer is subject to mandatory clearance by the CNMV. Additionally, pursuant to the provisions of Law 10/2014 and Royal Decree 84/2015, the acquisition by BBVA of control of the Target Company resulting from the Offer is subject to the duty of prior notification to the Bank of Spain and the obtention of the non-opposition of the European Central Bank. In accordance with the provisions of article 26.2 of Royal Decree 1066/2007, the CNMV will not authorize the Offer until the express or tacit non-opposition of the European Central Bank has been obtained and evidenced.

In addition, completion of the Offer is also subject to the satisfaction of the conditions specified in the Prior Announcement, in particular (i) the acceptance of the Offer by holders of shares representing at least 50.01% of the share capital of the Target Company, (ii) approval by BBVA’s General Shareholders’ Meeting of the increase of BBVA’s share capital through the issue of new ordinary shares through non-cash contributions in an amount that is sufficient to fully cover the Consideration offered to the shareholders of the Target Company (which condition was satisfied on July 5, 2024, as described below), (iii) the express or tacit authorization of the economic concentration resulting from the Offer by the Spanish antitrust authorities, and (iv) the express or tacit authorization of the indirect acquisition of control of the Target Company’s banking subsidiary in the United Kingdom, TSB Bank PLC, by the United Kingdom Prudential Regulation Authority (PRA).

On July 5, 2024, the BBVA’s Extraordinary General Shareholders' Meeting resolved to authorize, with 96% votes in favor, an increase in the share capital of BBVA of up to a maximum nominal amount of €551,906,524.05 through the issuing and putting into circulation of up to 1,126,339,845 ordinary shares of €0.49 par value each to fully cover the Consideration offered to the shareholders of the Target Company.

The closing of the Offer is expected to be completed in between approximately 6 and 8 months from the date of the Prior Announcement and the detailed terms of the Offer will be set out in the prospectus, which was submitted to CNMV together with the request for the authorization of the Offer on May 24, 2024, and will be published after obtaining the mandatory clearance of the CNMV.

Sustainability

Channeling sustainable business

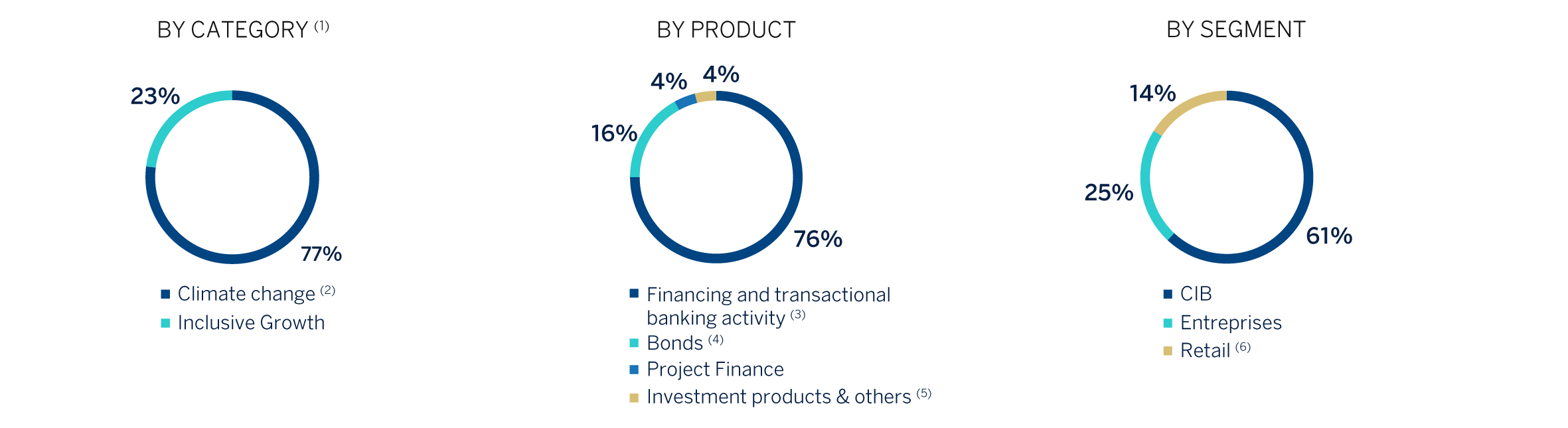

SUSTAINABLE BUSINESS BREAKDOWN (PERCENTAGE OF THE AMOUNT CHANNELED 2018-JUNE 2024)

(1) In those cases where it is not feasible or sufficient information is not available to allow an exact distribution between the categories of climate change and inclusive growth, internal estimates are made based on the available information.

(2) Also includes Natural Capital.

(3) Primarily includes products whose funds are used for activities considered sustainable (according to both internal and market standards, existing regulations and best practices), products granted to clients considered sustainable taking into account their revenues from sustainable activities (in accordance with existing regulations and/or internal standards) or in line with company-level certifications of recognized prestige in the market, as well as sustainability linked products (according to both internal and market standards and best practices), such as those linked to environmental and/or social indicators.

(4) Bonds (green, social, sustainability or sustainability-linked) in which BBVA acts as bookrunner.

(5) Investment products art.8 or 9 under Sustainable Finance Disclosure Regulation (SFDR) or similar criteria outside the EU managed, intermediated or marketed by BBVA. "Other" includes deposits under the Sustainable Transaction Banking Framework until its replacement by the CIB Sustainable Products Framework (both Frameworks published on the bank's website), insurance policies related to energy efficiency and inclusive growth and electric vehicle autorenting, mainly.

(6) Includes the activity of the BBVA Microfinance Foundation (BBVAMF), which is not part of the consolidated Group and which has channeled around €8.4 billion in the period from 2018 to June 2024 to support vulnerable entrepreneurs with microcredits.

Regarding the objective of channeling €300 billion between 2018 and 20252 as part of the sustainability strategy, the BBVA Group has channeled an approximate total of €252 billion in sustainable business between 2018 and June 2024, of which approximately 77% corresponds to the area of promoting the fight against climate change and the remaining 23% to promote inclusive growth. The amount channeled includes financing, intermediation, investment, off-balance sheet and insurance transactions. These operations have contractual maturity or redemption dates, so the above mentioned accumulated figure does not represent the amount reflected on the balance sheet.

During the first half of 2024, around €46 billion was channeled, of which around €26 billion corresponds to the second quarter of 2024, a new quarterly record for the Group. This channeling of the first half of 2024 represents an increase of around 37% compared to the same half of 2023.

Of the amount channeled in the first half of 2024, around €5.3 billion corresponds to retail business, representing a growth of 12% compared with the same period of the previous year. During the second quarter, around €2.8 billion was channeled. BBVA has continued to promote customized digital solutions aimed at the mass consumer market, offering retail customers a vision of the potential savings they can obtain by adopting energy-saving measures in their homes and transportation. During the second quarter of 2024, the good performance of channeling related to the acquisition of hybrid or electric vehicles stands out, with a total of around €164 million channeled, representing a 13% growth compared to the same period of the previous year.

Between January and June 2024, the commercial business (enterprises) mobilized around €15.8 billion, representing a growth of 57% compared to the same period of the previous year. In the second quarter of 2024, approximately €9 billion was channeled, while continuing to advise corporate customers on sustainable solutions that enable potential economic savings with a focus on cross-cutting issues, such as energy efficiency, vehicle fleet renewal or water footprint reduction. It is worth highlighting the financing allocated to agribusiness, water and circular economy with around €655 million during the second quarter of 2024, which represents an increase of 74% compared to the same period of the previous year.

CIB has channeled around €25 billion during the first half of the year, representing a 32% growth compared to the same period of the previous year. During this quarter, around €13.8 billion have been mobilized. In the wholesale segment, BBVA has continued to promote the financing of clean technologies and renewable energy projects, as well as confirming linked to sustainability, among other strategic lines. In terms of channeling in the second quarter of 2024, the financing of renewable energy projects stood out, which contributed around €402 million during the quarter, more than doubled the amount compared to the same period of the previous year.

Relevant advances in the field of sustainability

- Intermediate emission reduction targets for 20303

Following the publication of its interim 2030 emissions reduction targets for the aviation and shipping sectors at the end of 2023, and following the defined roadmap, BBVA published in May 2024 interim 2030 funded emissions reduction targets for two additional sectors: aluminum and real estate (both commercial and residential)4.

In the case of aluminum, BBVA has set its target to align its financing portfolio with the decarbonization trajectory determined by the International Aluminum Institute (IAI) to reduce global emissions by 28% by 2030. This means achieving a percentage deviation of 0% or less from this decarbonization path by 2030.

In the case of the BBVA Group's real estate portfolio, different targets have been set for the Commercial Real Estate segment, where the objective is to reduce the intensity of its financing portfolio by 44% between 2023 and 2030, and for the Residential Real Estate segment, with a reduction target for that period of 30%5. - Issuance of a biodiversity bond

In May 2024, BBVA Colombia and the International Finance Corporation (IFC) have announced the issuance of a biodiversity bond. BBVA Colombia will issue the bond of up to $70 million and the proceeds will be used to finance projects focused on reforestation, regeneration of natural forests on degraded lands, mangrove conservation or rehabilitation, climate-smart agriculture, and wildlife habitat restoration, among others.

1 Considering the last official update of the countercyclical capital buffer, calculated on the basis of exposure as of March 31, 2024.

2 For the purposes of the Goal 2025, channeling is considered to be any mobilization of financial flows, cumulatively, in relation with activities, clients or products considered to be sustainable or promoting sustainability in accordance with internal standards inspired by existing regulations, market standards such as the Green Bond Principles, the Social Bond Principles and the Sustainability Linked Bond Principles of the International Capital Markets Association, as well as the Green Loan Principles, Social Loan Principles and the Sustainability Linked Loan Principles of the Loan Market Association, existing regulations, and best market practices. The foregoing is understood without prejudice to the fact that said mobilization, both at an initial stage or at a later time, may not be registered on the balance sheet. To determine the financial flows channeled to sustainable business, internal criteria is used based on both internal and external information, either from public sources, provided by customers or by a third party (mainly data providers and independent experts).

3 The achievement and progressive progress of the decarbonization targets will depend to a large extent on the actions of third parties, such as customers, governments and other stakeholders, and may therefore be materially affected by such actions, or lack thereof, as well as by other exogenous factors that do not depend on BBVA (including, but not limited to, new technological and regulatory developments, military conflicts, the evolution of climate and energy crises, etc.). Consequently, these objectives may be subject to future revisions.

4 The geographic scope of the intermediate 2030 emission reduction target for the real estate sector is Spain.

5 BBVA has established its targets following the CRREM (Carbon Risk Real Estate Monitor) methodology, which defines a metric in terms of emissions intensity (Kg CO2e per square meter per year).