Spain

Highlights

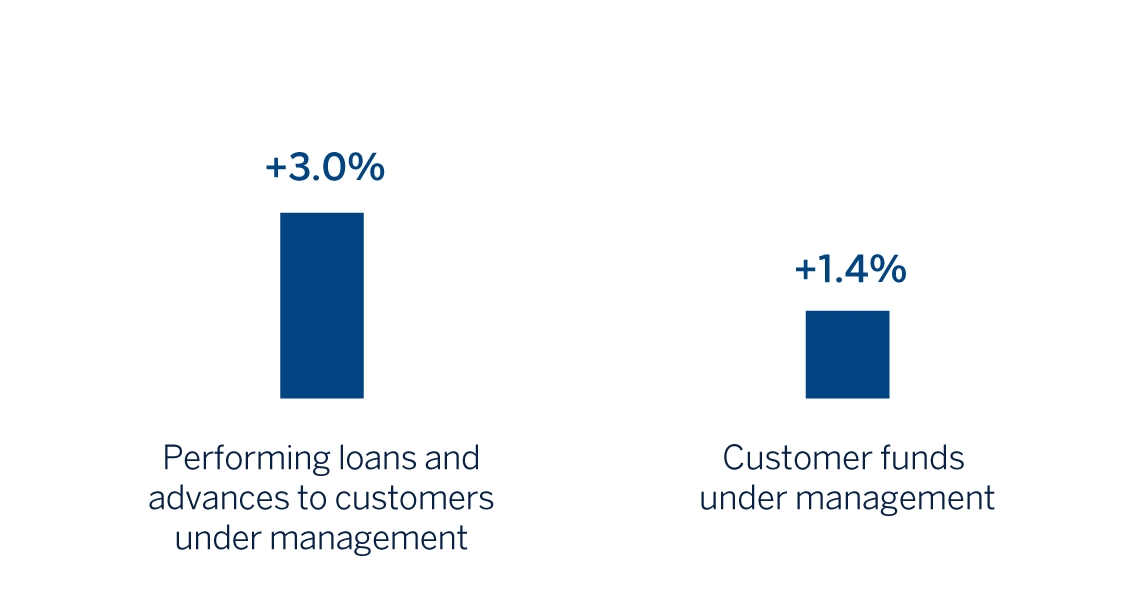

- Growth in lending and customer funds in the quarter

- Good performance of the recurring revenue

- Reduction of the NPL ratio and stability of the cost of risk

- Improvement of the efficiency ratio and remarkable quarterly results

BUSINESS ACTIVITY (1)

(VARIATION COMPARED TO 31-12-23)

(1) Excluding repos.

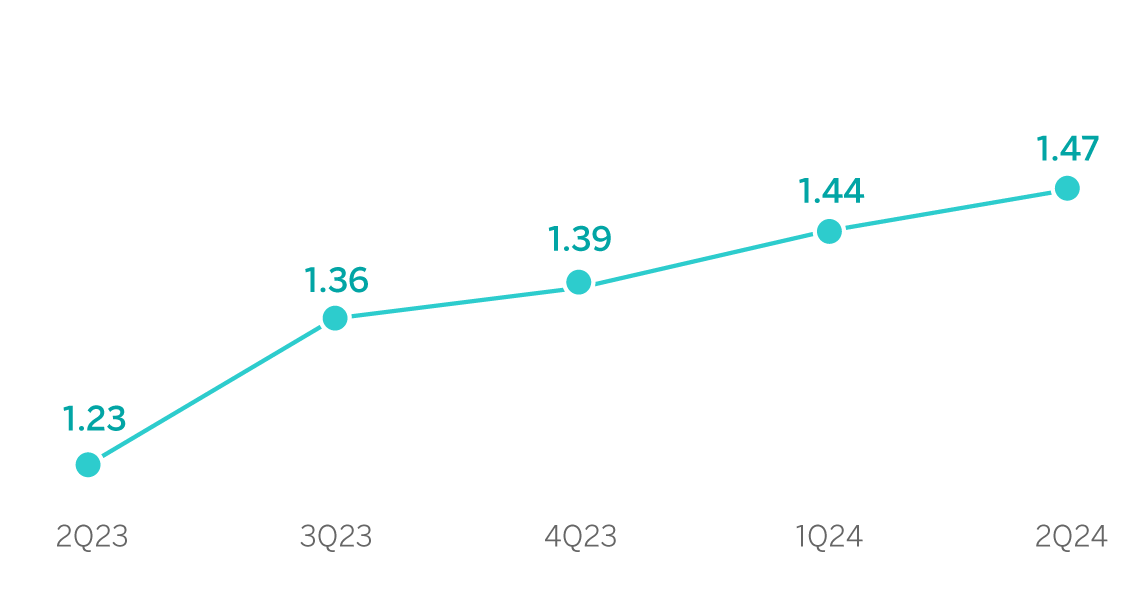

NET INTEREST INCOME / AVERAGE TOTAL ASSETS

(PERCENTAGE)

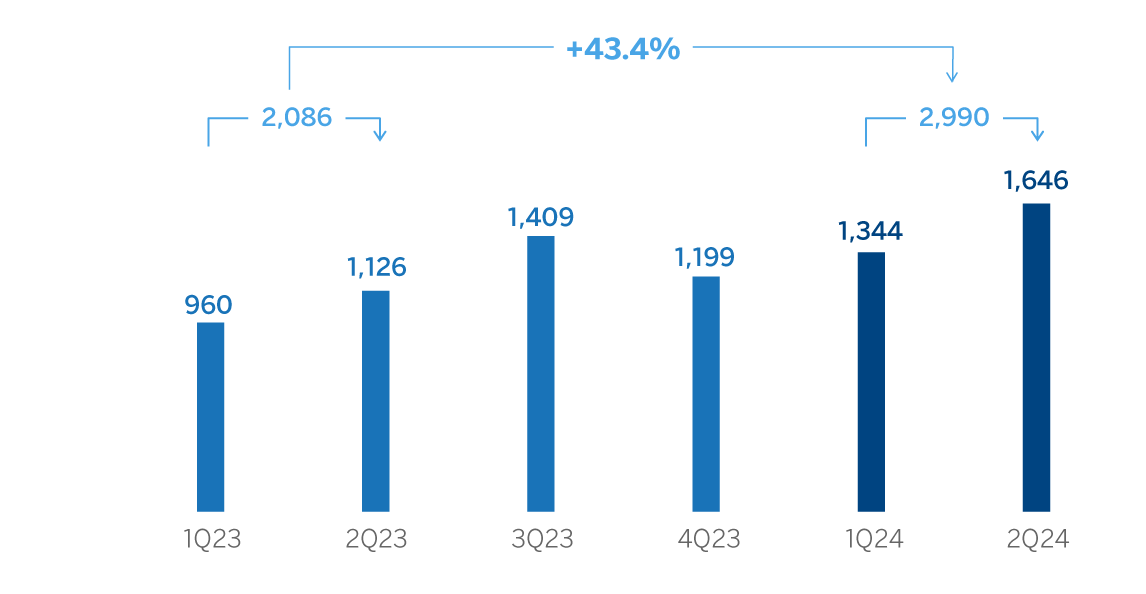

OPERATING INCOME

(MILLIONS OF EUROS)

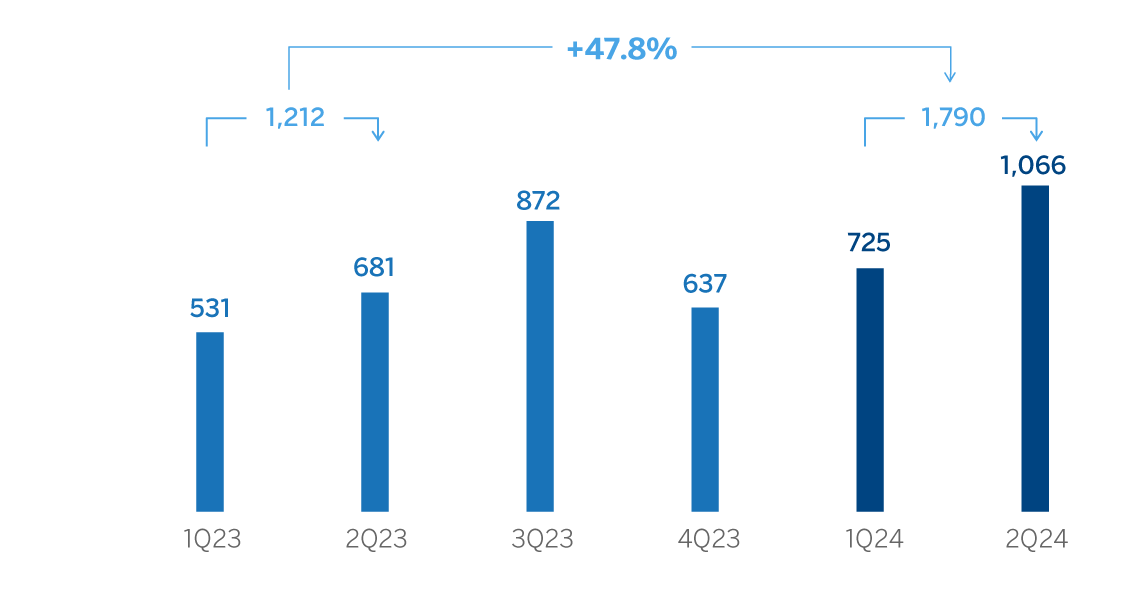

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS)

| FINANCIAL STATEMENTS AND RELEVANT BUSINESS INDICATORS (MILLIONS OF EUROS AND PERCENTAGE) | |||

|---|---|---|---|

| Income statement | 1H24 | ∆ % | 1H23 (1) |

| Net interest income | 3,211 | 26.2 | 2,544 |

| Net fees and commissions | 1,144 | 4.7 | 1,093 |

| Net trading income | 358 | 64.3 | 218 |

| Other operating income and expenses | (88) | (60.7) | (224) |

| Of which: Insurance activities | 197 | 3.0 | 192 |

| Gross income | 4,626 | 27.4 | 3,630 |

| Operating expenses | (1,636) | 5.9 | (1,545) |

| Personnel expenses | (863) | 1.5 | (851) |

| Other administrative expenses | (589) | 16.9 | (504) |

| Depreciation | (183) | (3.8) | (190) |

| Operating income | 2,990 | 43.4 | 2,086 |

| Impairment on financial assets not measured at fair value through profit or loss | (335) | 39.3 | (240) |

| Provisions or reversal of provisions and other results | (52) | 1.0 | (51) |

| Profit (loss) before tax | 2,603 | 45.1 | 1,794 |

| Income tax | (811) | 39.6 | (581) |

| Profit (loss) for the period | 1,792 | 47.8 | 1,213 |

| Non-controlling interests | (1) | 30.2 | (1) |

| Net attributable profit (loss) | 1,790 | 47.8 | 1,212 |

Balance sheets | 30-06-24 | ∆ % | 31-12-23 |

| Cash, cash balances at central banks and other demand deposits | 15,991 | (64.2) | 44,653 |

| Financial assets designated at fair value | 127,669 | (12.6) | 146,136 |

| Of which: Loans and advances | 50,245 | (28.5) | 70,265 |

| Financial assets at amortized cost | 234,062 | 8.2 | 216,334 |

| Of which: Loans and advances to customers | 178,273 | 2.9 | 173,169 |

| Inter-area positions | 36,426 | (15.0) | 42,869 |

| Tangible assets | 2,816 | (2.4) | 2,884 |

| Other assets | 4,069 | (13.4) | 4,697 |

| Total assets/liabilities and equity | 421,032 | (8.0) | 457,573 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 78,270 | (29.9) | 111,701 |

| Deposits from central banks and credit institutions | 33,865 | (22.5) | 43,694 |

| Deposits from customers | 225,381 | 3.7 | 217,235 |

| Debt certificates | 49,991 | (2.9) | 51,472 |

| Inter-area positions | — | — | — |

| Other liabilities | 18,425 | (0.8) | 18,579 |

| Regulatory capital allocated | 15,100 | 1.4 | 14,892 |

Relevant business indicators | 30-06-24 | ∆ % | 31-12-23 |

| Performing loans and advances to customers under management (2) | 174,783 | 3.0 | 169,712 |

| Non-performing loans | 8,086 | (1.2) | 8,189 |

| Customer deposits under management (2) | 214,859 | (0.5) | 216,005 |

| Off-balance sheet funds (3) | 102,652 | 5.6 | 97,253 |

| Risk-weighted assets | 121,668 | (0.1) | 121,779 |

| Efficiency ratio (%) | 35.4 | 40.5 | |

| NPL ratio (%) | 3.9 | 4.1 | |

| NPL coverage ratio (%) | 54 | 55 | |

| Cost of risk (%) | 0.38 | 0.37 | |

(1) Revised balances. For more information, please refer to the “Business Areas” section.

(2) Excluding repos.

(3) Includes mutual funds, customer portfolios and pension funds.

Macro and industry trends

Financial indicators continue to show dynamism in economic activity, largely due to services exports, fiscal policy, European recovery funds as well as the increase in active population caused by factors such as greater active population. In this context, BBVA Research's forecast for GDP growth in 2024 has been revised upwards from 2.1% to 2.5%, a rate identical to that recorded in 2023 and significantly higher than that forecast for the Eurozone. On the other hand, annual inflation reached 3.4% in June 2024 and it is expected to remain close to this level during the second half of the year.

As for the banking system, data at the end of May 2024 showed that the volume of credit to the private sector declined by 2.5% year-on-year. At the end of May, household and non-financial corporate loan portfolios fell by 1.0% and 2.9% year-on-year, respectively. Customer deposits increased by 7.5% year-on-year as of the end of May 2024, due to a 0.8% increase in demand deposits, and 70.4% time deposits. The NPL ratio stood at 3.6% in May 2024, practically the same as in the same month of the previous year. Furthermore, the system maintains comfortable solvency and liquidity levels.

Activity

The most relevant aspects related to the area's activity during the first half of 2024 were:

- Loan balances were higher than at the end of December (+3.0%), highlighting the growth in the commercial segment (+2.6%), public sector (+16.2%) and mortgages (+1.2%).

- Total customer funds grew in the first half (+1.4%), as a result of the performance of off-balance sheet funds (mutual and pension funds), which increased by 5.6%, mainly favored by net contributions in the first half of the year and a very positive market effect, and by the evolution of time deposits, which grew by 5.3%.

The most relevant aspects related to the area's activity during the second quarter of 2024 were:

- Growth in lending compared to the end of March (+2.4%), with good dynamics in all retail segments, as well as in the SMEs and public sector.

- Regarding credit quality, the NPL ratio decreased compared to the end of the previous quarter and stood at 3.9%, favored by the impact of portfolio sales at the end of June of non-performing loans (mostly unsecured), and with a negative effect on the NPL coverage ratio, which has reduced to 54% as of the end of June 2024.

- Total customer funds remained stable in the second quarter of the year (+0.1%, with respect to the balances at the end of March 2024), with a decrease in time deposits (-10.8%), offset by the growth of demand deposits (+1.0%) and off-balance sheet funds (+2.1%), which registered positive net contributions, as well as a very favorable market effect.

Results

Spain generated a net attributable profit of €1,790m in the first half of 2024, 47.8% higher than in the same period of the previous year, mainly supported by the favorable evolution of every line item of the gross income, especially the net interest income.

The most relevant aspects of the year-on-year changes in the area's income statement at the end of June 2024 were:

- Net interest income increased by 26.2%, mainly supported by the increase in the customer spread in a context of higher benchmark interest rates compared to the first half of 2023, as well as an effective liability management, which has kept the cost of deposits contained.

- Commissions grew by 4.7% compared to the same period of the previous year. The contribution of asset management fees, insurance and securities fees and fees related to CIB operations, with significant transactions in the first quarter of the year, were noteworthy.

- Growth in the NTI contribution (+64.3%), mainly supported by portfolio management and, to a lesser extent, by the contribution of Global Markets.

- The other operating income and expenses line includes the total annual estimated amount for the temporary tax on credit institutions and financial credit institutions for year 2024 of €285m, which is €60m higher than that registered in the same period of the previous year. The year-on-year comparison is mainly affected by the absence of contribution to the SRF in 2024.

- Operating expenses increased by 5.9%, mainly due to an increase in general expenses, as a result of inflation, especially higher IT expenses, and to a lesser extent in personnel expenses. This growth is well under the increase of the gross income (+27.4%), which allowed a very significant improvement of the efficiency ratio by 719 basis points in the last twelve months.

- Impairment on financial assets increased by 39.3%, in line with expectations, mainly due to higher recurrent flows in retail portfolios in the context of high rates. As a result of the above, the cumulative cost of risk at the end of June 2024 stood at 0.38%, remaining stable in comparison with the cumulative cost of risk at the end of March 2024.

In the second quarter of 2024, Spain generated a net attributable profit of €1,066m, which represents a growth of 47.1% compared to the previous quarter, which included the total estimated annual amount of the temporary levy on credit institutions and financial credit establishments in the other operating revenues and expenses line. Apart from the above, recurring revenues performed well, offset by a lower NTI. On the lower part of the income statement, expenses were in line with the previous quarter and provisions for impairment on financial assets increased, due to a slightly higher recurring entries in the wholesale portfolio, offset by the evolution of the provisions and other results line.