The BBVA share

Global growth has continued to give signs of improvement in the first half of 2017. The most recent figures also suggest some stabilization looking forward. The general improvement in confidence and global trade are underpinning the economic acceleration. In addition, central banks are continuing their support and there is relative calm in the financial markets. Performance in the developed economies continues to be positive, above all in Europe. In contrast, in Latin America recent trends suggest moderate growth, although with differences between the countries. In China, growth is expected to slow in the coming months. As a result of the above, global growth could be around 3.3% in 2017, according to BBVA Research estimates.

Against this backdrop, the main stock market indices delivered positive results in the first half of the year. This was the result of a strong boost from general rises in the first quarter, and a second quarter in which performance was mixed (slight losses in Europe, stability in Spain and gains in the United States). In this respect, in Europe, the Stoxx 50 has gained 3.7% since December 2016, while the Euro Stoxx 50 gained 4.6%; and in Spain, the Ibex 35 also increased by 11.7%. The S&P 500, which tracks the share prices of U.S. companies, also performed positively, registering a 8.2% rise.

The banking sector, in Europe in particular, has outperformed the general market indices in the first six months of the year. The European Stoxx Banks index, which includes British banks, gained 7.1%, while the Eurozone bank index, the Euro Stoxx Banks, gained 11.5%. In contrast, in the United States, the S&P Regional Banks sector index performed worse than the market with a downturn of 1%.

The BBVA share remained stable in the last quarter, closing June at €7.27, with a gain of 13.3% since December 2016, representing a relatively better performance than the European banking sector and the Ibex 35.

BBVA share evolution compared with European indices

(Base indice 100=30-06-2016)

The BBVA share and share performance ratios

| 30-06-17 | 31-12-16 | |

|---|---|---|

| Number of shareholders | 910,330 | 935,284 |

| Number of shares issued | 6,667,886,580 | 6,566,615,242 |

| Daily average number of shares traded | 42,015,051 | 47,180,855 |

| Daily average trading (million euros) | 286 | 272 |

| Maximum price (euros) | 7.89 | 6.88 |

| Minimum price (euros) | 5.92 | 4.50 |

| Closing price (euros) | 7.27 | 6.41 |

| Book value per share (euros) | 7.18 | 7.22 |

| Tangible book value per share (euros) | 5.82 | 5.73 |

| Market capitalization (million euros) | 48,442 | 42,118 |

| Yield (dividend/price; %) (1) | 5.1 | 5.8 |

- (1) Calculated by dividing shareholder remuneration over the last twelve months over the closing price at the end of the period.

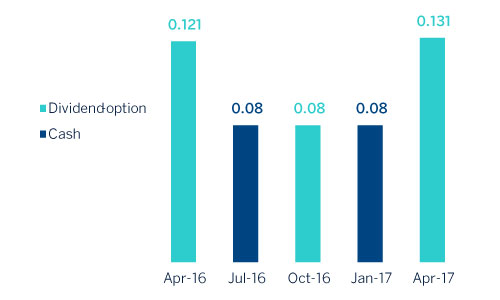

As regards shareholder remuneration, the last ''dividend-option'' was paid in April 2017, with 83.28% of the holders of free assignment rights choosing to receive new shares. Looking forward, in line with the significant event published on February 1, 2017, BBVA intends to distribute between 35% and 40% of profits obtained each year fully in cash. This shareholder remuneration policy will be formed each year of an interim dividend (which is expected to be paid in October) and a final dividend (which will be paid out upon completion of the final year and following approval of the application of the result, foreseeably in April). These payouts will be subject to appropriate approval by the corresponding governing bodies

Shareholder remuneration

(Euros-gross-/share)

As of June 30, 2017, the number of BBVA shares amounted to 6,678 million, and the number of shareholders was 910,330. Residents in Spain hold 43.57% of the share capital, while the percentage owned by non-resident shareholders stands at 56.43%.

Shareholder structure (30-06-2017)

| Numbers of shares |

Shareholders | Shares | ||

|---|---|---|---|---|

| Number | % | Number | % | |

| Up 150 | 190,209 | 20.9 | 13,500,956 | 0.2 |

| 151 to 450 | 187,471 | 20.6 | 51,197,762 | 0.8 |

| 451 to 1,800 | 285,001 | 31.3 | 276,805,556 | 4.2 |

| 1,801 to 4,500 | 129,868 | 14.3 | 370,167,831 | 5.6 |

| 4,501 to 9,000 | 60,339 | 6.6 | 380,397,359 | 5.7 |

| 9,001 to 45,000 | 50,891 | 5.6 | 886,690,865 | 13.3 |

| More than 45,001 | 6,551 | 0.7 | 4,689,126,251 | 70.3 |

| Total | 910,330 | 100.0 | 6,667,886,580 | 100.0 |

BBVA shares are traded on the Continuous Market of the Spanish Stock Exchanges and also on the stock exchanges in London and Mexico. BBVA American depositary shares (ADS) are traded on the New York Stock Exchange and on the Lima Stock Exchange (Peru), under an exchange agreement between these two markets. Among the main stock market indices, BBVA shares are included on the Ibex 35, Euro Stoxx 50 and Stoxx 50, with a weighting of 8.88%, 2.08% and 1.34% respectively. They are also listed on several sector indices, including the Euro Stoxx Banks, with a weighting of 9.08%, and the Stoxx Banks, with a weighting of 4.54%.

Finally, BBVA maintains a significant presence on a number of international sustainability indices or ESG (environmental, social and governance) indices, which evaluate the performance of companies in this area, as summarized in the table below.

Sustainability indices on which BBVA is listed as of 30-06-2017 (1)

(1)The inclusion of BBVA in any MSCI index, and the use of MSCI logos, trademarks, service marks or index names herein donot constitute a sponsorship, endorsement or promotion of BBVA by MSCI or any of its affiliates. The MSCI indices are the exclusive property of MSCI. MSCI and MSCI index names and logos are trademarks or service marks of MSCI or its affiliates.