Gross income for 2013 amounted to €5,630m, 25.3% up on the figure for the same period the previous year. This positive performance is a result of the area’s capacity to generate recurring revenue, thanks to the boost to activity in all geographical areas and the maintenance of customer spreads. Net interest income for 2013 was €4,703m (up 33.6% year-on-year) and income from fees and commissions was up 27.7% to €976m. NTI also performed very well, doubling the figure for the previous year, largely influenced by the revaluation of BBVA Provincial’s U.S. dollar positions in Venezuela, due to the aforementioned devaluation of the bolivar. Lastly, other income/expenses was weaker in the quarter as the adjustment for hyperinflation in Venezuela was more negative than in 2012, which offset the good performance in the insurance business in the area.

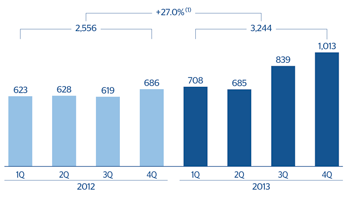

On the side of costs, South America is continuing with its expansion and technological transformation plans in order to take advantage of the growth opportunities presented by the region. An example of this is the launch of the new Strategic Plan for 2013-2016. These factors, combined with the high inflation in the area, explain why operating expenses have remained high, with a year-on-year increase of 23.2% to €2,386m. The efficiency ratio has improved on the third quarter of 2013 and ended the fourth quarter at 42.4%. Finally, operating income stands at €3,244m, up 27.0% on the figure reported in the same period in 2012.

Impairment losses on financial assets increased significantly to €701m, affected by the high level of recoveries and one-off items booked in 2012. Not including these effects, the growth of 26% is in line with the strength of activity.

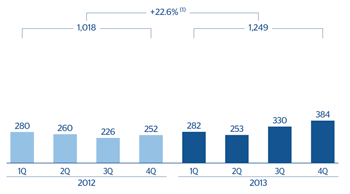

Overall, South America generated a net attributable profit in 2013 of €1,249m, a year-on-year rise of 22.6%.

This can be broken down by country as follows:

- Argentina has generated a net attributable profit of €214m (up 39.2% year-on-year), supported by the strength of recurring revenue (boosted by increased activity and good price management, which have offset increased expenses and loan-loss provisions).

- Chile had a net attributable profit of €119m, reflecting positive evolution of revenue, particularly NTI, despite the impact of the low inflation rate on the return on indexed assets.

- Colombia increased its net interest income significantly, thanks to the boost from activity and maintenance of spreads, which has offset the increase in expenses and loan-loss provisions, the latter in line with lending, and generated a net attributable profit of €296m.

- Peru registered a net attributable profit of €167m, based on increases in net interest income and NTI. Income from fees and commissions slowed due to the effect of the Transparency Act, which limits banks from charging certain fees.

- Venezuela has increased its net attributable profit substantially (up 63.1% year-on-year) to €369m, thanks to strong activity and the positive effect of the revaluation of the bank’s U.S. dollar positions following the devaluation by the Venezuelan government in February.

- Lastly, BBVA Paraguay reported a cumulative net attributable profit of €22m and BBVA Uruguay €24m.

South America. Operating income(Million euros at constant exchange rates) |

South America. Net attributable profit(Million euros at constant exchange rates) |

|---|---|

(1) At current exchange rates: +5.8%. |

(1) At current exchange rates: +4.1%. |

South America. Data per country

(Million euros)

|

|

Operating income | Net attributable profit | ||||||

|---|---|---|---|---|---|---|---|---|

| Country | 2013 | Δ % | Δ % at constant exchange rates |

2012 | 2013 | Δ % | Δ % at constant exchange rates |

2012 |

| Argentina | 509 | 15.3 | 43.6 | 442 | 214 | 11.8 | 39.2 | 191 |

| Chile | 336 | 7.4 | 13.2 | 313 | 119 | (20.9) | (16.7) | 151 |

| Colombia | 525 | 1.9 | 9.4 | 516 | 296 | 0.3 | 7.8 | 295 |

| Perú | 651 | 1.4 | 7.4 | 642 | 167 | (2.3) | 3.5 | 170 |

| Venezuela | 1,116 | 5.1 | 53.2 | 1,061 | 369 | 11.9 | 63.1 | 329 |

| Otros países (1) | 108 | 15.9 | 19.7 | 93 | 84 | 36.5 | 41.2 | 62 |

| Total | 3,244 | 5.8 | 27.0 | 3,066 | 1,249 | 4.1 | 22.6 | 1,199 |