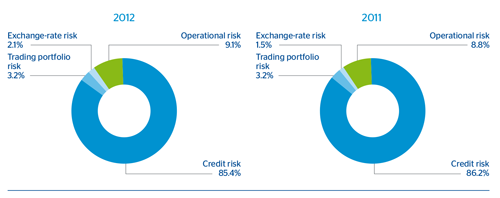

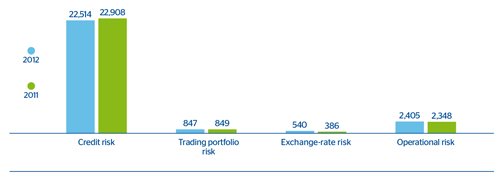

The accompanying table shows total capital requirements itemized by credit risk, trading-book risk, exchange rate risk, operational risk and other requirements as of December 31, 2012 and 2011.

The total amount for credit risk includes the positions in securitizations (standardized and advanced approach) and equity portfolio.

Capital requirements by risk type

(Million euros)

|

|

Capital amount | |

|---|---|---|

| Exposure categories and risk types | 2012 | 2011 |

| Central governments and central banks | 1,229 | 709 |

| Regional governments and local authorities | 149 | 284 |

| Public-sector institutions and other public entities | 86 | 100 |

| Multilateral development banks | 2 | 0 |

| Institutions | 357 | 295 |

| Corporates | 5,190 | 5,216 |

| Retail | 2,420 | 2,137 |

| Collateralized with real-estate property | 1,663 | 1,588 |

| Default status | 694 | 639 |

| High risk | 155 | 210 |

| Guaranteed bonds | 8 | 1 |

| Short-term to Institutions and Corporates | 12 | 14 |

| Mutual funds | 4 | 17 |

| Other exposures | 1,039 | 942 |

| Securitized positions | 239 | 406 |

| TOTAL CREDIT RISK BY THE STANDARDIZED APPROACH | 13,246 | 12,558 |

| Central governments and central banks | 17 | 45 |

| Institutions | 1,139 | 1,252 |

| Corporates | 5,135 | 6,139 |

| Retail | 2,060 | 2,153 |

| Secured by real-estate collateral | 1,190 | 1,524 |

| Qualifying revolving retail | 598 | 489 |

| Other retail assets | 272 | 141 |

| Equity | 795 | 706 |

| By method: |

|

|

| Simple Method | 176 | 217 |

| PD/LGD Method | 497 | 371 |

| Internal Models | 122 | 118 |

| By nature: |

|

|

| Exchange-traded equity instruments | 517 | 495 |

| Non-trading equity instruments in sufficiently diversified portfolios | 278 | 212 |

| Securitized position | 122 | 53 |

| TOTAL CREDIT RISK BY THE ADVANCED MEASUREMENT APPROACH | 9,268 | 10,350 |

| TOTAL CREDIT RISK | 22,514 | 22,908 |

| Standard: | 155 | 161 |

| Price Risk from fixed-income positions | 119 | 106 |

| Correlation risk | 12 | 35 |

| Price Risk from equity portfolios | 23 | 20 |

| Advanced: Market risk | 693 | 688 |

| TOTAL TRADING-BOOK ACTIVITY RISK 847 849 | 847 | 849 |

| EXCHANGE-RATE RISK (STANDARDIZED APPROACH) 540 386 | 540 | 386 |

| OPERATIONAL RISK (1) 2,405 2,348 | 2,405 | 2,348 |

| OTHER CAPITAL REQUIREMENTS | 47 | 71 |

| CAPITAL REQUIREMENTS | 26,353 | 26,562 |

Capital requirements variation due to credit risk is affected by opposite movements, first reflects the reduction in assets of business in Spain in line with the process of deleveraging underway in the country's economy, and In contrast, lending in South America grew very significantly over the year due to the positive performance of economies in most of the countries in the region in which the Group operates. The appreciation of their currencies during this period also had an impact on the increase in risk-weighted assets.

The increase in the capital requirements for exchange-rate risk is due to increases in the non-hedged part of structural positions.

The amounts shown in the table above on credit risk include the counterparty risk in trading-book activity as shown below:

(Million euros)

|

|

Capital amount | |

|---|---|---|

| Counterparty risk trading-book activities | 2012 | 2011 |

| Standardized approach | 205 | 214 |

| Advanced measurement | 481 | 749 |

| Total | 686 | 962 |

The management of new netting and collateral agreements have reduced the capital requirements for counterparty risk.

The Group currently has no capital requirements for trading-book activity liquidation risk.